Question: An analyst plans to use P/E and the method of comparables as a basis for recommending purchasing shares of one of two peer - group

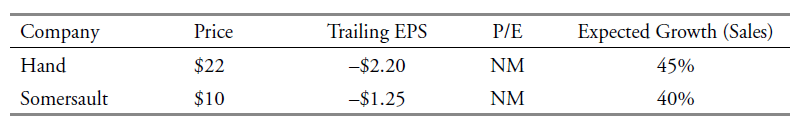

An analyst plans to use P/E and the method of comparables as a basis for recommending purchasing shares of one of two peer - group companies in the business of manufacturing personal digital assistants. Neither company has been profitable to date, and neither is expected to have positive EPS over the next year. Data on the companies€™prices, trailing EPS, and expected growth rates in sales (five - year compounded rates) are given in the following table:

Unfortunately, because the earnings for both companies have been negative, their P/Es are not meaningful. On the basis of this information, address the following:

A. Discuss how the analyst might make a relative valuation in this case.

B. State which stock the analyst should recommend.

Company Trailing EPS Expected Growth (Sales) P/E Price Hand $22 -$2.20 45% NM Somersault $10 -$1.25 40% NM

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

A The analyst can rank the two stocks by earnings yield EP Whether EPS is positive or negative a low... View full answer

Get step-by-step solutions from verified subject matter experts