Question: As shown in Exhibit 5, LOral reported an operating margin of 16% in 2011, which makes it the most profitable company among beauty companies. However,

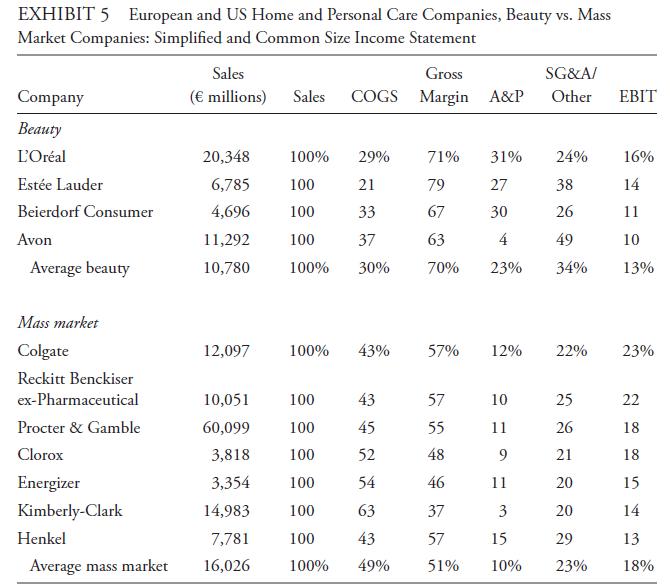

As shown in Exhibit 5, L’Oréal reported an operating margin of 16% in 2011, which makes it the most profitable company among beauty companies. However, the average operating margin of 18% for home and personal goods companies operating in mass markets is even greater than that of L’Oréal. L’Oréal costs are similar to a luxury goods company with high gross margin of 71% that is offset by high “go to market” costs for advertising and promotion (A&P) expenditures. With the exception of Avon, the business model of which is based on direct selling, A&P is substantially greater at the beauty companies than at the mass market producers.

L’Oréal is often considered to be a pure beauty company. But if the underlying business is considered in detail, the company’s operations can be split 50/50 between a luxury beauty high-end part and a general consumer part. In the general consumer part, L’Oréal’s products compete with such players as Colgate, Procter & Gamble, and Henkel in the mass market. Exhibit 5 presents relevant data.2

i. Assuming the following information, what will L’Oréal’s new operating margin be?

• L’Oréal’s beauty and mass market operations each represent half of revenues.

• L’Oréal will be able to bring the overall costs structure of its mass market operations in line with the average of mass market companies (EBIT = 18%).

• The cost structure of L’Oréal’s beauty operations will remain stable (EBIT = 16%).

ii. What will happen to L’Oréal’s operating margin if the company is able to adjust the operating cost structure of its mass market segment (50% of revenues) partly toward the average of its mass markets peers but keep its high gross margin?

Assume the following:

• The cost structure of half of the business, the beauty operations, will remain stable (EBIT = 16%).

• L’Oréal’s mass market operations will have a gross margin of 61% (the average of the current gross margin of 71% and the 51% reported by its mass market peers).

• L’Oréal’s A&P costs will fall half from 31% of sales to 15% of sales, and other costs will remain stable.

EXHIBIT 5 European and US Home and Personal Care Companies, Beauty vs. Mass Market Companies: Simplified and Common Size Income Statement Company Sales Gross SG&A/ ( millions) Sales COGS Margin A&P Other EBIT Beauty L'Oral 20,348 100% 29% 71% 31% 24% 16% Este Lauder 6,785 100 21 79 27 38 14 Beierdorf Consumer 4,696 100 33 67 30 26 11 Avon 11,292 100 37 63 4 49 10 Average beauty 10,780 100% 30% 70% 23% 34% 13% Mass market Colgate 12,097 100% 43% 57% 12% 22% 23% Reckitt Benckiser ex-Pharmaceutical 10,051 100 43 57 10 25 22 Procter & Gamble 60,099 100 45 55 11 26 18 Clorox 3,818 100 52 48 9 21 18 Energizer 3,354 100 54 46 11 20 15 Kimberly-Clark 14,983 100 63 37 3 20 14 Henkel 7,781 100 43 57 15 29 13 Average mass market 16,026 100% 49% 51% 10% 23% 18%

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

i Operating margin will increase from 16 to 17 which is 50 of 18 mass market EBIT plus 50 of 16 ... View full answer

Get step-by-step solutions from verified subject matter experts