Axis Manufacturing Company, Inc. (AXCI), a very small company in terms of market capitalization, has total assets

Question:

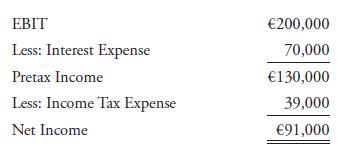

Axis Manufacturing Company, Inc. (AXCI), a very small company in terms of market capitalization, has total assets of €2 million financed 50 percent with debt and 50 percent with equity capital. The cost of debt is 7 percent before taxes; this example assumes that interest is tax deductible, so the after-tax cost of debt is 4.9 percent.4 The cost of equity capital is 12 percent. The company has earnings before interest and taxes (EBIT) of €200,000 and a tax rate of 30 percent. Net income for AXCI can be determined as follows:

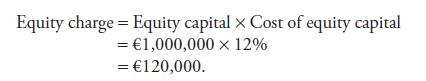

With earnings of €91,000, AXCI is clearly profitable in an accounting sense. But was the company’s profitability adequate return for its owners? Unfortunately, it was not. To incorporate the cost of equity capital, compute residual income. One approach to calculating residual income is to deduct an equity charge (the estimated cost of equity capital in money terms) from net income. Compute the equity charge as follows:

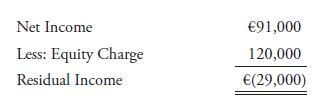

As stated, residual income is equal to net income minus the equity charge:

AXCI did not earn enough to cover the cost of equity capital. As a result, it has negative residual income. Although AXCI is profitable in an accounting sense, it is not profitable in an economic sense.

Step by Step Answer: