Carla Espinosa is an analyst following Pitts Corporation at the end of 2012. From the data in

Question:

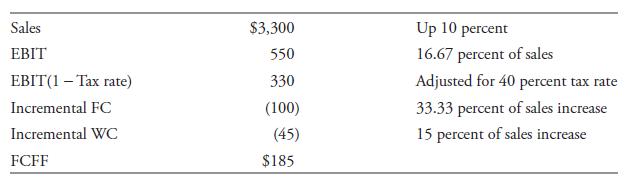

Carla Espinosa is an analyst following Pitts Corporation at the end of 2012. From the data in Example 6, she can see that the company’s sales for 2012 were \($3000\) million, and she assumes that sales grew by \($300\) million from 2011 to 2012. Espinosa expects Pitts Corporation’s sales to increase by 10 percent a year thereafter. Pitts Corporation is a fairly stable company, so Espinosa expects it to maintain its historical EBIT margin and proportions of incremental investments in fixed and working capital. Pitts Corporation’s EBIT for 2012 is \($500\) million; its EBIT margin is 16.67 percent (500/3,000), and its tax rate is 40 percent.

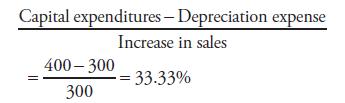

Note from Pitts Corporation’s 2012 statement of cash flows (Exhibit 11) the amount for “purchases of fixed assets” (i.e., capital expenditures) of \($400\) million and depreciation of \($300\) million. Thus, incremental fixed capital investment in 2012 was

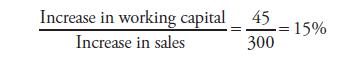

Incremental working capital investment in the past year was

So, for every \($100\) increase in sales, Pitts Corporation invests \($33.33\) in new equipment in addition to replacement of depreciated equipment and \($15\) in working capital.

Espinosa forecasts FCFF for 2013 as follows (dollars in millions):

Step by Step Answer: