Consider two hypothetical companies, Company A and Company B, that have constant cash revenues and cash expenses

Question:

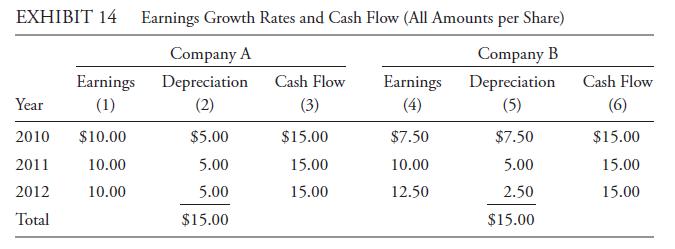

Consider two hypothetical companies, Company A and Company B, that have constant cash revenues and cash expenses (as well as a constant number of shares outstanding) in 2010, 2011, and 2012. In addition, both companies incur total depreciation of \($15.00\) per share during the three-year period, and both use the same depreciation method for tax purposes. The two companies use different depreciation methods, however, for financial reporting. Company A spreads the depreciation expense evenly over the three years (straight-line depreciation, SLD). Because its revenues, expenses, and depreciation are constant over the period, Company A’s EPS is also constant. In this example Company A’s EPS is assumed to be \($10\) each year, as shown in Column 1 in Exhibit 14.

Company B is identical to Company A except that it uses accelerated depreciation.

Company B’s depreciation is 150 percent of SLD in 2007 and declines to 50 percent of SLD in 2009, as shown in Column 5.

Because of the different depreciation methods used by Company A and Company B for financial reporting purposes, Company A’s EPS is flat at \($10.00\) (Column 1) whereas Company B’s EPS (Column 4) shows 29 percent compound growth:

(\($12.50\) /\($7.50\)1/2/) − 1.00 = 0.29. Thus, Company B appears to have positive earnings momentum. Analysts comparing Companies A and B might be misled by using the EPS numbers as reported instead of putting EPS on a comparable basis. For both companies, however, cash flow per share is level at \($15\) .

Depreciation may be the simplest noncash charge to understand; write-offs and other noncash charges may offer more latitude for the management of earnings.

Step by Step Answer: