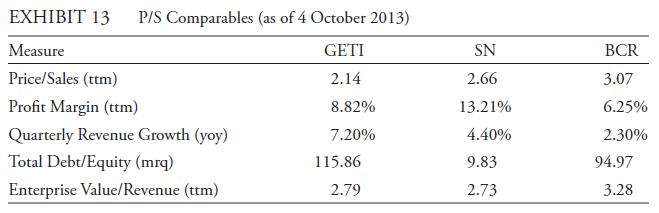

Question: Continuing with the project to value Getinge AB, you have compiled the information on GETI and peer companies Smith & Nephew plc (London: SN) and

Continuing with the project to value Getinge AB, you have compiled the information on GETI and peer companies Smith & Nephew plc (London: SN) and CR Bard Inc.

(NYSE: BCR) given in Exhibit 13.

Use the data in Exhibit 13 to address the following:

i. Based on the P/S but referring to no other information, assess GETI’s relative valuation.

ii. State whether GETI is more closely comparable to SN or to BCR. Justify your answer.

EXHIBIT 13 P/S Comparables (as of 4 October 2013) Measure GETI SN BCR Price/Sales (ttm) 2.14 2.66 3.07 Profit Margin (ttm) 8.82% 13.21% 6.25% Quarterly Revenue Growth (yoy) 7.20% 4.40% 2.30% Total Debt/Equity (mrq) 115.86 9.83 94.97 Enterprise Value/Revenue (ttm) 2.79 2.73 3.28

Step by Step Solution

3.26 Rating (144 Votes )

There are 3 Steps involved in it

i Because the PS for GETI 214 is the lowest of the three PS multiples if no ... View full answer

Get step-by-step solutions from verified subject matter experts