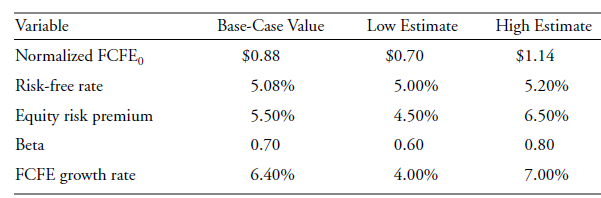

Kenneth McCoin is valuing McInish Corporation and performing a sensitivity analysis on his valuation. He uses a

Question:

A. Use the base - case values to estimate the current value of McInish Corporation.

B. Calculate the range of stock prices that would occur if the base - case value for FCFE0 were replaced by the low estimate and the high estimate for FCFE0. Similarly, using the base - case values for all other variables, calculate the range of stock prices caused by using the low and high values for beta, the risk - free rate, the equity risk premium, and the growth rate. Based on these ranges, rank the sensitivity of the stock price to each of the five variables.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Equity Asset Valuation

ISBN: 978-0470571439

2nd Edition

Authors: Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe, Abby Cohen

Question Posted: