Kirstin Kruse, a portfolio manager, has an important client who wants to alter the composition of her

Question:

Kirstin Kruse, a portfolio manager, has an important client who wants to alter the composition of her equity portfolio, which is currently a diversified portfolio of 60 global common stocks. Because of concerns about the economy and based on the thesis that the consumer staples sector will be less hurt than others in a recession, the client wants to add a group of stocks from the consumer staples sector. In addition, the client wants the stocks to meet the following criteria:

• Stocks must be considered large cap (i.e., have a large market capitalization).

• Stocks must have a dividend yield of at least 4.0 percent.

• Stocks must have a forward P/E no greater than 15.

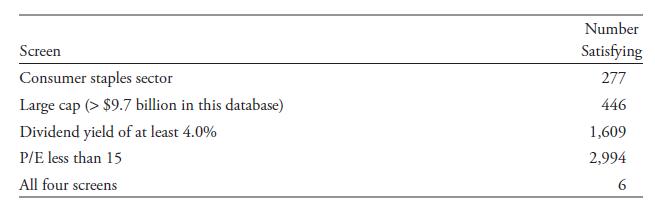

The following table shows how many stocks satisfied each screen, which was run in July 2008.

The stocks meeting all four screens were Altria Group, Inc.; British American Tobacco (the company’s ADR); Reynolds American, Inc.; Tesco PLC (the ADR); Unilever N.V.

(the ADR); and Unilever PLC (the ADR).

A. Critique the construction of the screen.

B. Do these criteria identify appropriate additions to this client’s portfolio?

Step by Step Answer: