While Weeramantry has been researching Microsoft, his colleague Delacour has been investigating the required return on Larsen

Question:

While Weeramantry has been researching Microsoft, his colleague Delacour has been investigating the required return on Larsen & Toubro Ltd. shares (BSE: 500510, NSE:

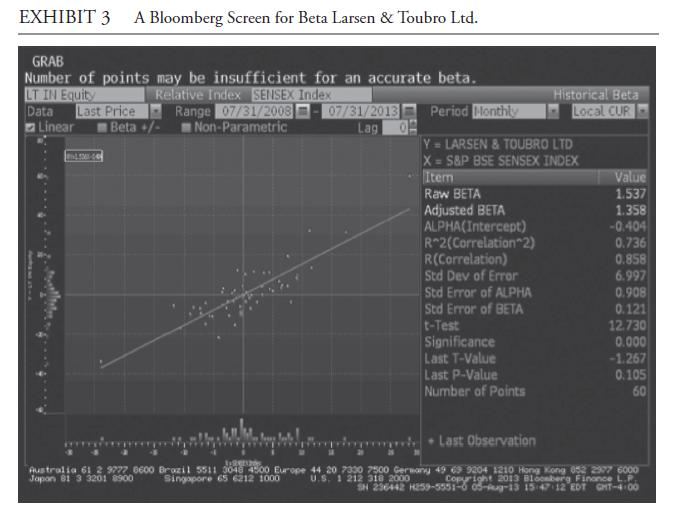

LT).36 Larsen & Toubro Ltd. is the largest India-based engineering and construction company. Calling up the beta function for LT on her Bloomberg terminal on 31 July 2013, Delacour sees the screen shown in Exhibit 3.

Delacour notes that Bloomberg has chosen the Sensex as the equity index for estimating beta. Delacour changes the Bloomberg default for time period/frequency to the specification shown in the exhibit for consistency with her other estimation work; in doing so, she notes approvingly that the beta estimate is approximately the same at both horizons.

Raw beta, 1.537, is the slope of the regression line running through the scatterplot of 60 points denoting the return on LT (y-axis) for different returns on the Sensex (x-axis); a bar graph of the distribution of returns in local currency terms is superimposed over the x-axis.

Noting from R2 that beta explains more than 73 percent of variation in LT returns—an exceptionally good fit—Delacour also decides to use the CAPM to estimate LT stock’s required return.37 Delacour has decided to use her own adjusted historical estimate of 4.0 percent for the Indian equity risk premium and the 10-year Indian government bond yield of 8.7 percent as the risk-free rate.38 Delacour notes that an 8.7 percent yield is shown on the Bloomberg cost of capital screen for LT (as the “bond rate”)

and that the same screen shows an estimate of the Indian equity risk premium (“country premium”) of 3.3 percent—close to her own estimate of 4.0 percent.

Based only on the information given, address the following:

i. Demonstrate the calculation of adjusted beta using the Blume method.

ii. Estimate the required return on LT using the CAPM with an adjusted beta.

iii. Explain one fact from the Bloomberg screen as evidence that beta has been estimated with accuracy.

Step by Step Answer: