You are valuing the stock of International Business Machines Corporation (NYSE: IBM) as of early August 2013,

Question:

You are valuing the stock of International Business Machines Corporation (NYSE:

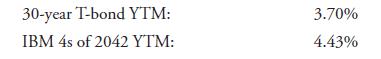

IBM) as of early August 2013, and you have gathered the following information:

The IBM bonds, you note, are investment grade (rated AA– by Standard & Poor’s, Aa3 by Moody’s Investors Service, and A+ by Fitch). The beta on IBM stock is 0.73. In prior valuations you have used a risk premium of 3 percent in the bond yield plus risk premium approach. However, the estimated beta of IBM has decreased over the past five years.

As a matter of judgment, you have decided as a consequence to use a risk premium of 2.75 percent in the bond yield plus risk premium approach.

i. Calculate the cost of equity using the CAPM. Assume that the equity risk premium is 4.20 percent.

ii. Calculate the cost of equity using the bond yield plus risk premium approach, with a risk premium of 2.75 percent.

iii. Suppose you found that IBM stock, which closed at $195.04 on 31 July 2013, was slightly undervalued based on a DCF valuation using the CAPM cost of equity from Question 1. Does the alternative estimate of the cost of equity from Question 2 support the conclusion based on Question 1?

Step by Step Answer: