Refer to the information in E109. Power Drive Corporation has the following beginning balances in its stockholders

Question:

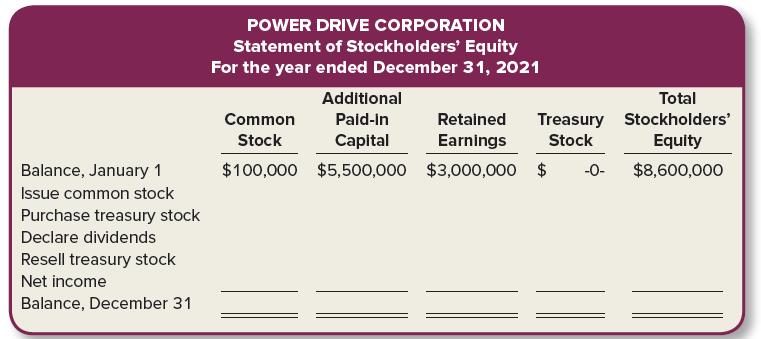

Refer to the information in E10–9. Power Drive Corporation has the following beginning balances in its stockholders’ equity accounts on January 1, 2021: Common Stock, $100,000; Additional Paid-in Capital, $5,500,000; and Retained Earnings, $3,000,000. Net income for the year ended December 31, 2021, is $700,000.

Required:

Taking into consideration all the transactions recorded in E10–9, prepare the statement of stockholders’ equity for Power Drive Corporation for the year ended December 31, 2021, using the format provided.

E10-9

Power Drive Corporation designs and produces a line of golf equipment and golf apparel. Power Drive has 100,000 shares of common stock outstanding as of the beginning of 2021. Power Drive has the following transactions affecting stockholders’ equity in 2021.

March 1 Issues 65,000 additional shares of $1 par value common stock for $62 per share.

May 10 Purchases 6,000 shares of treasury stock for $65 per share.

June 1 Declares a cash dividend of $2.00 per share to all stockholders of record on

June 15. Dividends are not paid on treasury stock.

July 1 Pays the cash dividend declared on June 1.

October 21 Resells 3,000 shares of treasury stock purchased on May 10 for $70 per share.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Financial Accounting

ISBN: 978-1259914898

5th edition

Authors: David Spiceland, Wayne M. Thomas, Don Herrmann