Question: This problem was introduced in the text towards the end of the chapter. The information you need to solve this problem is included in the

This problem was introduced in the text towards the end of the chapter. The information you need to solve this problem is included in the table below.

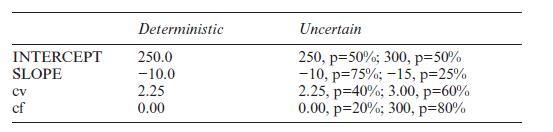

Interpretation: There is a 50% chance that the intercept of the price– response function is 250 and a 50% chance that it is 300.

The slope takes a value of −10.0 with a 75% probability and −15.0 with a 25% probability. There is a 40% chance that the variable costs will be $2.25/ unit and a 60% chance that they will be $3.00 per unit.

Finally, the fixed costs will be $0 with a probability of 20% and $300 with a probability of 80%. The objective function must now be based on a summary of many simulated trials of the profit. You shall now maximize (1) the average simulated profit from 1,000 trials and (2) the minimum profit level from all simulated trials.

To solve this problem you must use the Evolutionary solver in Excel.

Deterministic Uncertain 250, p=50%; 300, p=50% -10, p=75%; -15, p=25% 2.25, p=40%; 3.00, p=60% 0.00, p=20%; 300, p=80% INTERCEPT 250.0 SLOPE -10.0 CV 2.25 cf 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts