One of the theories regarding initial public offering (IPO) pricing is that the initial return y (the

Question:

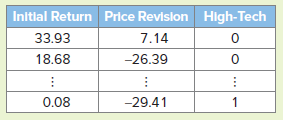

One of the theories regarding initial public offering (IPO) pricing is that the initial return y (the percentage change from offer to open price) on an IPO depends on the price revision x (the percentage change from pre-offer to offer price). Another factor that may influence the initial return is a high-tech dummy variable that equals 1 for high-tech firms and 0 otherwise. The following table shows a portion of the data on 264 IPO firms from January 2001 through September 2004.

a. Estimate y = ?0 + ?1x + ?2d + ? where the dummy variable d equals 1 for firms that are high-tech. Use the estimated model to predict the initial return of a high-tech firm with a 10% price revision. Find the corresponding predicted return of a firm that is not high-tech.

b. Estimate y = ?0 + ?1x + ?2d + ? where the dummy variable d equals 1 for firms that are not high-tech. Use the estimated model to predict the initial return of a high-tech firm with a 10% price revision. Find the corresponding predicted return of a firm that is not high-tech.

c. In the above two models, determine if the dummy variable is significant at the 5% level.

Step by Step Answer:

Essentials Of Business Statistics Communicating With Numbers

ISBN: 9781260547658

2nd Edition

Authors: Sanjiv Jaggia, Alison Kelly