Question:

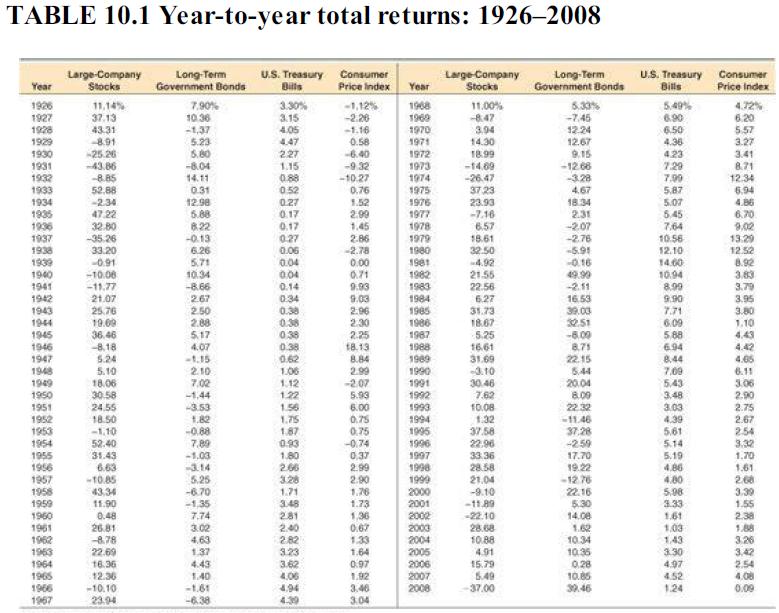

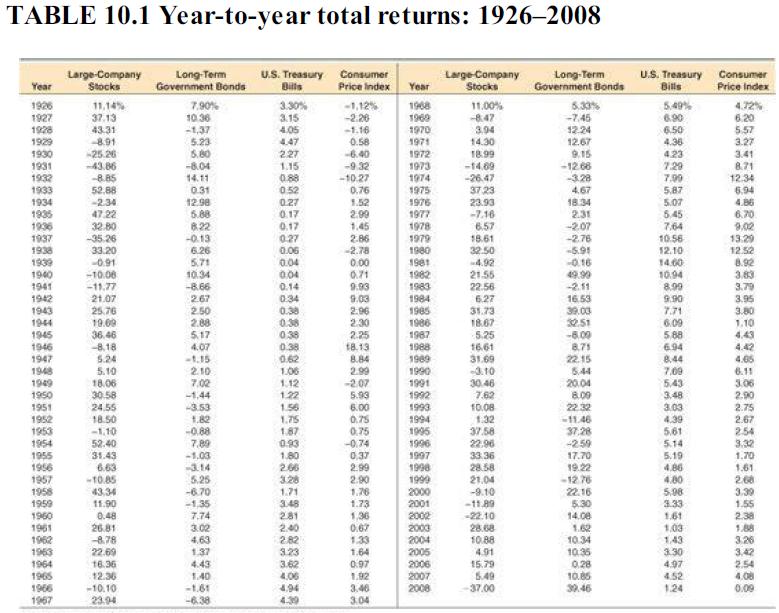

Refer to Table 10.1 in the text and look at the period from 1973 through 1978.

a. Calculate the arithmetic average returns for large-company stocks and T-bills over this time period.

b. Calculate the standard deviation of the returns for large-company stocks and T-bills over this time period.

c. Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. What was the arithmetic average risk premium over this period? What was the standard deviation of the risk premium over this period?

d. Is it possible for the risk premium to be negative before an investment is undertaken? Can the risk premium be negative after the fact? Explain.

Stocks

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Transcribed Image Text:

TABLE 10.1 Year-to-year total returns: 1926–2008 Large-Company Stocks Long-Term Government Bonds U.S. Treasury Consumer Price Index Large-Company Stocks Long-Term Government Bonds U.S. Treasury Consumer Bills Year Bills Year Price Index 1926 1927 1928 11,14% 37.13 43.31 8.91 7.90% 10.36 -1,37 5.23 5.80 3.30% 3.15 -1,12% -2.20 -1.16 0.58 -6.40 1968 11.00% -847 5.33% 5.49% 4.72% 6.20 5.57 3.27 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 -7.45 12.24 12.67 9.15 6.90 6.50 4.36 4.05 1929 1930 1931 1932 1933 1934 1935 1936 1937 3.94 14.30 18.99 -14.69 -26.47 37.23 23.93 -7.16 6.57 18.61 32.50 4.92 4.47 25.26 43.86 227 1.15 0.88 0.52 0.27 0.17 0.17 027 0.06 4.23 7.29 7.90 5,87 5.07 5.45 7.64 10.56 3.41 8.71 12.34 6.94 -8.04 14.11 0.31 12.98 5.88 8.22 -0.13 -9.32 -10.27 0,76 -12.66 -3.28 4.67 18.34 2.31 -2.07 -8.85 52.88 -2.34 1.52 4.86 47.22 32.80 -35.26 2.99 1.45 2.86 -2.78 0.00 0.71 -2.76 -5.91 0.16 49.90 -2.11 16.53 39.00 32.51 6.70 9.02 13.29 12.52 8.92 3.83 3.79 3.95 3.80 1938 33.20 6.26 12.10 1939 1940 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 -0.91 -10.06 -11.77 21.07 25.76 19.09 36.46 -8,18 5.24 5.10 18.06 30.58 5.71 10.34 -8.66 2.67 2.50 14.60 10.94 0.04 0.04 0.14 0.34 0.38 21.55 22.56 9.93 9.03 2.96 2.30 2.25 18.13 8.84 2.99 -2.07 5.93 8.99 9.90 7.71 2.88 5.17 4.07 -1.15 2.10 7.02 -1,44 -3.53 0.38 0.38 0.38 0.62 1.06 1.12 1.22 1.56 1.75 1.87 0.93 1.80 266 3.28 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 6.27 31.73 18.67 5.25 16.61 31.69 -3.10 30.46 7.62 10.08 1.32 37.58 22.96 6.09 5.88 6.94 8.44 7.09 5,43 3.48 3.03 4.39 5.61 5.14 1.10 4.43 4.42 4.65 6.11 3.06 2.90 2.75 2.67 2.54 3.32 -6.00 8.75 22.15 5.44 20.04 8.00 22.32 11.46 37.28 -259 17.70 19.22 -12.76 22.16 5.30 14.08 1.62 10.34 10.35 0.28 10.85 39.46 1951 24.55 6.00 0.75 0.75 -0.74 0.37 2.99 2.90 1.76 1.73 1,36 0.67 1.33 1.64 0.97 1.92 3.46 3.04 1952 1953 1954 18.50 -1.10 52.40 31.43 6.63 10.85 1.82 -0.88 7.89 -1.03 -3.14 5.25 1955 1956 1957 1997 1998 1999 5.19 4.86 4.80 33.36 1.70 1.61 2.68 1958 1959 1960 1961 1962 1963 28.58 21.04 -9.10 -11.89 -22.10 28.68 43,34 11.90 0.48 26.81 -6.70 -1,35 7,74 3.02 1.71 3.48 2.81 2000 2001 2002 2003 5.98 3.33 1.61 1.03 1.43 3.39 1.55 2.38 1.88 3.26 3.42 2.54 4.08 0.09 2.40 282 -8.78 22.69 16.36 12.36 -10.10 23.94 4,63 1.37 4.43 1.40 -1.61 3.23 3.62 4.06 4.94 4.39 2004 2005 2006 2007 2008 10.88 4.91 15.79 5.49 -37.00 3.30 4.97 4.52 1.24 1964 1965 1966 1967 -6.38