Refer to the observed capital structures given in Table 15.3 of the text. What do you notice

Question:

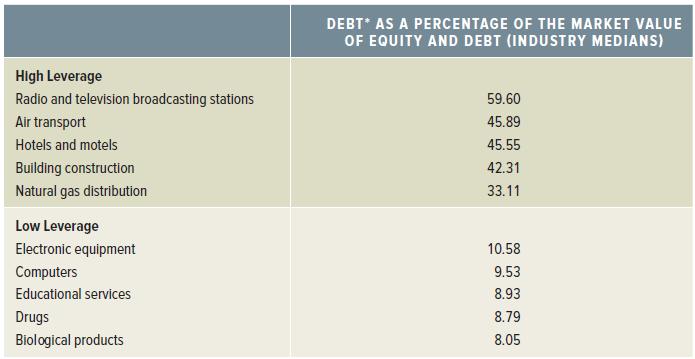

Refer to the observed capital structures given in Table 15.3 of the text. What do you notice about the types of industries with respect to their average debt–equity ratios? Are certain types of industries more likely to be highly leveraged than others? What are some possible reasons for this observed segmentation? Do the operating results and tax history of the firms play a role? How about their future earnings prospects? Explain.

Table 15.3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted: