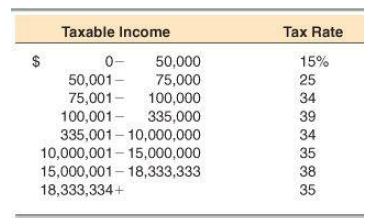

The SGS Co. had $275,000 in taxable income. Using the rates from Table 2.3 in the chapter,

Question:

The SGS Co. had $275,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate the company’s income taxes.

Table 2.3

Transcribed Image Text:

Taxable Income Tax Rate 0- 50,001– 75,001- 100,001- 335,000 335,001 – 10,000,000 10,000,001- 15,000,000 15,000,001- 18,333,333 18,333,334+ 50,000 15% 75,000 25 100,000 34 39 34 35 38 35 %24

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 58% (12 reviews)

Using Table 23 we can see the marginal tax schedule The first 5000...View the full answer

Answered By

Jehal Shah

I believe everyone should try to be strong at logic and have good reading habit. Because If you possess these two skills, no matter what difficult situation is, you will definitely find a perfect solution out of it. While logical ability gives you to understand complex problems and concepts quite easily, reading habit gives you an open mind and holistic approach to see much bigger picture.

So guys, I always try to explain any concept keeping these two points in my mind. So that you will never forget any more importantly get bored.

Last but not the least, I am finance enthusiast. Big fan of Warren buffet for long term focus investing approach. On the same side derivatives is the segment I possess expertise.

If you have any finacne related doubt, do reach me out.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Essentials Of Corporate Finance

ISBN: 9780073382463

7th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

The Fly Leaf Co. had $315,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate the company's income taxes.

-

The SGS Co. had $243,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate the company's income taxes. Table 2.3 Taxable Income Tax Rate 0 50,000 50,00175,000 75,001-...

-

Duela Dent is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her income taxes.? Taxable Income Tax Rate 9,525 10% 9,525 38,700 12 38,700- 82,500...

-

The following are selected transactions of Sarasota Department Store Ltd. for the current year ended December 31. Sarasota is a private company operating in the province of Manitoba where PST is 8%...

-

If T: V U is a linear transformation where dim V - n, show that TST = T for some isomorphism S: V V. [Let {e1,..., er, er+1,...,en] be as in Theorem 5 7.2. Extend {T(e1),..., T(er)} to a basis of...

-

It is difficult to predict gas prices given a multitude of factors affecting them. Consider 22 weeks of the average weekly regular gasoline price ($ per gallon) in New England and the West Coast. a....

-

Continuing to focus on evidence associated with the act, concealment, and conversion, use the evidentiary material to continue the examination. In addition, the examiner also starts to think of terms...

-

At December 31, 2010, Fell Corporation had a deferred tax liability of $680,000, resulting from future taxable amounts of $2,000,000 and an enacted tax rate of 34%. In May 2011, a new income tax act...

-

DATABASE: SQL Data Manipulation Language (DML) : Insert, Update & Delete Statements What are the Command to insert, update and delete data within the database tables please explain? Table Student...

-

Helix Company produces costumes used in the television and movie industries. Recently the company received an ongoing order for Samurai robes to be worn in an upcoming Japanese historical action...

-

Klingon Widgets, Inc., purchased new cloaking machinery three years ago for $4 million. The machinery can be sold to the Romulans today for $6.2 million. Klingons current balance sheet shows net...

-

Rotweiler Obedience Schools December 31, 2009, balance sheet showed net fixed assets of $1.725 million, and the December 31, 2010, balance sheet showed net fixed assets of $2.04 million. The companys...

-

Maximize f = 2x + 5y subject to - 4x + y 40 x - 7y 70 If there is no solution, indicate this; if there are multiple solutions, find two different solutions. Use the simplex method, with x 0, y 0.

-

Your company has been a one of the few producers of your product. You multisource one of your key inputs from nearly a dozen small suppliers, and have been nearly the only market for some of the...

-

Find the net charge of a system consisting of 6.21106 electrons and 7.8710 protons. Express your answer in coulombs. View Available Hint(s) Qnet = Submit Part B t O ? C Find the net charge of a...

-

Assume market demand characterized by MPB(Q)=168-2Q (MPB=marginal private benefit, and is the same as the price in the demand function), and market supply characterized by MPC(Q)=12+2Q (MPC is the...

-

Bryan paid $96.00 for an item at the store that was 20% off the original price. What was the original price? The original price for the item was $ Round your answer to the nearest cent.

-

Express the total-spin states |1, 1) and |1, 1) (with respect to the z-axis, as usual) of a system made of two spin- particles in terms of the product states | +x, +x), |+x, x), |x, +x), and | x,...

-

Sunspot Beverages, Ltd., of Fiji uses the weighted-average method in its process costing system. It makes blended tropical fruit drinks in two stages. Fruit juices are extracted from fresh fruits and...

-

Refer to the situation described inBE 18-13, but assume a 2-for-1 stock split instead of the 5% stock dividend. Prepare the journal entry to record the stock split if it is to be effected in the form...

-

In a large corporation what are the two distinct groups that report to the chief financial officer? Which group is the focus of corporate finance?

-

In a large corporation what are the two distinct groups that report to the chief financial officer? Which group is the focus of corporate finance?

-

In a large corporation what are the two distinct groups that report to the chief financial officer? Which group is the focus of corporate finance?

-

The following trial balance was drawn from the records of Zachary Company as of October 1, year 2. Cash Accounts receivable Inventory Store equipment Accumulated depreciation Accounts payable Line of...

-

Calculate the number of units sold and units remaining in ending inventory. Book "rint erences Check my wa Car Armour sells car wash cleaners. Car Armour uses a perpetual inventory system and made...

-

Eliminating Entries, Goodwill Pendragon Corporation acquired all of the stock of Sherwood, Inc. for $500 million in cash. Sherwood's shareholders' equity accounts at the date of acquisition were as...

Study smarter with the SolutionInn App