Using Excel to find the marginal tax rate can be accomplished with the VLOOKUP function. However, calculating

Question:

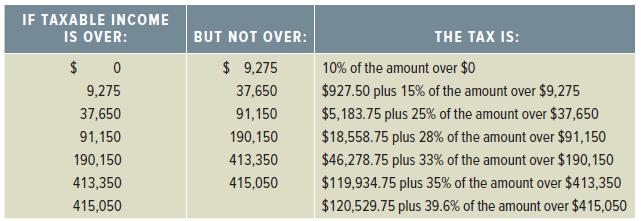

Using Excel to find the marginal tax rate can be accomplished with the VLOOKUP function. However, calculating the total tax bill is a little more difficult. Below we have shown a copy of the IRS tax table for an individual from a recent year. Often, tax tables are presented in this format.

In reading this table, the marginal tax rate for taxable income less than $9,275 is 10 percent. If the taxable income is between $9,275 and $37,650, the tax bill is $927.50 plus the marginal taxes. The marginal taxes are calculated as the taxable income minus $9,275 times the marginal tax rate of 15 percent.

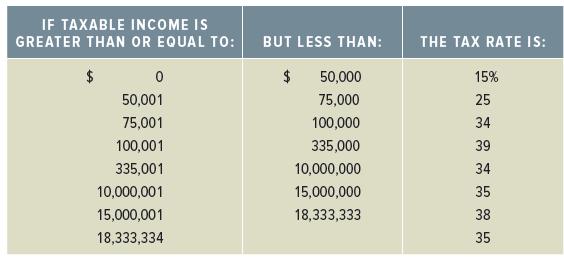

Below, we have the corporate tax table as shown in Table 2.3.

a. Create a tax table in Excel for corporate taxes similar to the individual tax table shown above. Your spreadsheet should then calculate the marginal tax rate, the average tax rate, and the tax bill for any level of taxable income input by a user.

b. For a taxable income of $1,350,000, what is the marginal tax rate?

c. For a taxable income of $1,350,000, what is the total tax bill?

d. For a taxable income of $1,350,000, what is the average tax rate?

Step by Step Answer:

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan