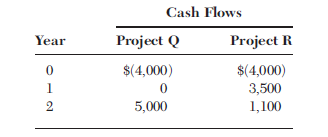

Question: Following is information about two mutually exclusive capital budgeting projects: If the firms required rate of return is 10 percent, which project should be purchased?

Following is information about two mutually exclusive capital budgeting projects:

If the firm€™s required rate of return is 10 percent, which project should be purchased?

Cash Flows Project R Year Project Q $(4,000) $(4,000) 1 3,500 1,100 5,000

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Cash Flows Year Project Q Project R 0 4000 4000 1 ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock

Document Format (2 attachments)

1516_605d88e16fdd4_652112.pdf

180 KBs PDF File

1516_605d88e16fdd4_652112.docx

120 KBs Word File