Question: The after-tax cash flows for two mutually exclusive projects have been estimated, and the following information has been provided: The companys required rate of return

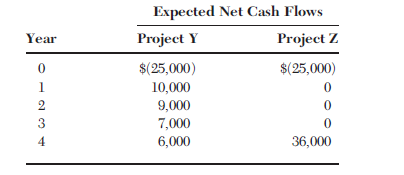

The after-tax cash flows for two mutually exclusive projects have been estimated, and the following information has been provided:

The company€™s required rate of return is 14 percent, and it can get unlimited funds at that cost. What is the IRR of the better project?

Expected Net Cash Flows Year Project Y Project Z $(25,000) $(25,000) 10,000 9,000 7,000 6,000 3 36,000 4

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

See the solutions for Problem 920 for examples as to how to compute NPV and IR... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1516_605d88e16ff9d_652116.pdf

180 KBs PDF File

1516_605d88e16ff9d_652116.docx

120 KBs Word File