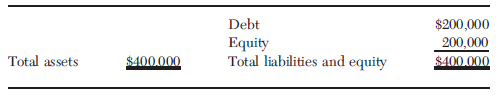

Two textile companies, Grimm Manufacturing and Wright Mills, began operations with identical balance sheets. A year later,

Question:

a. Show the balance sheet of each firm after the asset increase, and calculate each firm€™s new debt ratio. (Assume Wright€™s lease is kept off the balance sheet.)

b. Show how Wright€™s balance sheet would have looked immediately after the financing if it had capitalized the lease.

c. Would the rate of return (1) on assets and (2) on equity be affected by the choice of financing? How?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials of Managerial Finance

ISBN: 978-0324422702

14th edition

Authors: Scott Besley, Eugene F. Brigham

Question Posted: