Emerson Company is a small editorial services company owned and operated by Suzanne Emerson. On October 31,

Question:

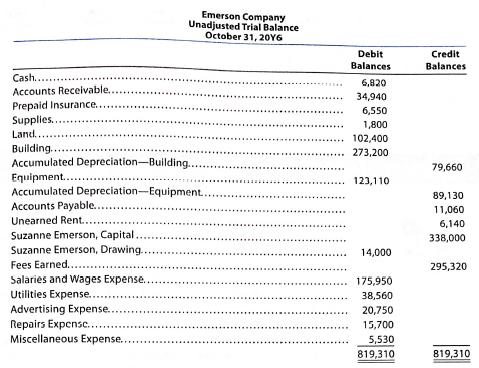

Emerson Company is a small editorial services company owned and operated by Suzanne Emerson. On October 31, 20Y6, Emerson Company's accounting clerk prepared the Unadjusted Trial balance shown on the next page

The data needed to determine year-end adjustments are as follows:

• Unexpired insurance at October 31, $550.

• Supplies on hand at October 31, $610.

• Depreciation of building for the year, $10,920.

• Depreciation of equipment for the year, $7,830.

• Unearned rent at October 31, $2,050.

• Accrued salaries and wages at October 31, $2,550.

• Fees earned but unbilled on October 31, $9,140.

Instructions

1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation Expense—Building, Depreciation Expense—Equipment, and Supplies Expense.

2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.

Step by Step Answer:

Accounting

ISBN: 9781337902687

28th Edition

Authors: Carl S. Warren, Christine Jonick, Jennifer Schneider