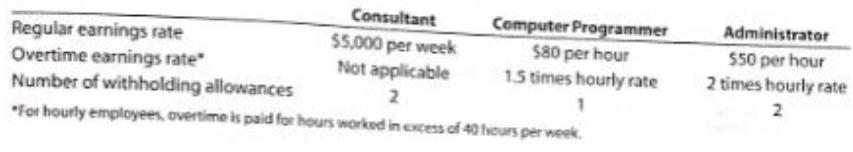

Floatin Away Company has three employeesa consultant, a computer programmer, and an administrator. The following payroll information

Question:

Floatin Away Company has three employees—a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee:

For the current pay period, the computer programmer worked 50 hours and the administrator worked 48 hours. The federal income tax withheld for all three employees, who are single, can be determined from the wage bracket withholding table in Exhibit 2 in the chapter. Assume further that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and one withholding allowance is $81. Determine the gross pay and the net pay for each of the three employees for the current pay period.

Step by Step Answer:

Accounting

ISBN: 9781337902687

28th Edition

Authors: Carl S. Warren, Christine Jonick, Jennifer Schneider