A zero coupon bond (a zero) pays a specified amount of money when it matures and nothing

Question:

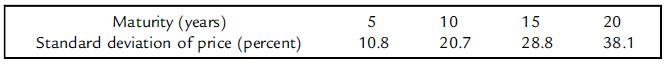

A zero coupon bond (a “zero”) pays a specified amount of money when it matures and nothing before the bond’s maturity. Financial theory teaches that the volatility of the price of a zero is proportional to its maturity. Use the data in Table 8.17 to estimate a least squares regression equation.

a. Which variable did you use for the dependent variable? Explain your reasoning.

b. Is the sign of the estimated slope consistent with financial theory?

c. What is the P value for a two-tailed test of the null hypothesis that the value of the slope is equal to 0?

d. What is the P value for a two-tailed test of the null hypothesis that the value of the slope is equal to 1?

e. Give a 95 percent confidence interval for the slope.

Step by Step Answer:

Essential Statistics Regression And Econometrics

ISBN: 9780123822215

1st Edition

Authors: Gary Smith