Many investors look at the beta coefficients provided by investment advisors based on least squares estimates of

Question:

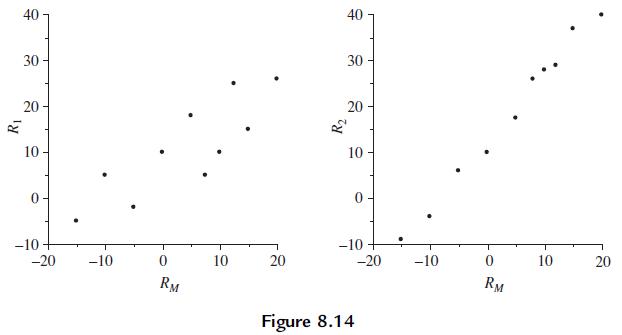

Many investors look at the beta coefficients provided by investment advisors based on least squares estimates of the model Ri = α + βRM + ε, where Ri is the rate of return on a stock and RM is the return on a market average, such as the S&P 500. Historical plots of the annual rates of return on two stocks and the market as a whole over a 10-year period are shown in Figure 8.14. During this period, which of these two stock returns had the higher

a. Mean?

b. Standard deviation?

c. Beta coefficient?

d. R2?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essential Statistics Regression And Econometrics

ISBN: 9780123822215

1st Edition

Authors: Gary Smith

Question Posted: