U.S. stock prices nearly doubled between 1980 and 1986. Was this a speculative bubble, based on nothing

Question:

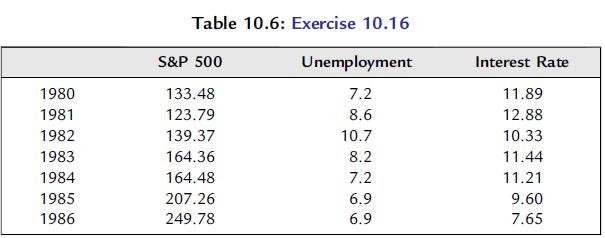

U.S. stock prices nearly doubled between 1980 and 1986. Was this a speculative bubble, based on nothing more than greed and wishful dreams, or can these higher prices be explained by changes in the U.S. economy during this period? While the fortunes of individual companies are buffeted by factors specific to their industry and the firm, the overall level of stock prices depends primarily on national economic activity and interest rates. When the economy is booming, corporations make large profits and stock prices should increase. For any given level of economic activity, an increase in interest rates makes bonds more attractive, putting downward pressure on stock prices. Table 10.6 shows the value of the S&P 500 index of stock prices, the percent unemployment rate, and the percent interest rate on long-term Treasury bonds.

a. Estimate a simple regression model with the S&P 500 the dependent variable and the unemployment rate the explanatory variable.

b. Estimate a simple regression model with the S&P 500 the dependent variable and the interest rate the explanatory variable.

c. Estimate a multiple regression model with the S&P 500 the dependent variable and the unemployment rate and interest rate the explanatory variables.

d. Are the unemployment rate and interest rate positively or negatively correlated during this period? How does this correlation explain the differences in the estimated coefficients in questions

a, b, and c?

Step by Step Answer:

Essential Statistics Regression And Econometrics

ISBN: 9780123822215

1st Edition

Authors: Gary Smith