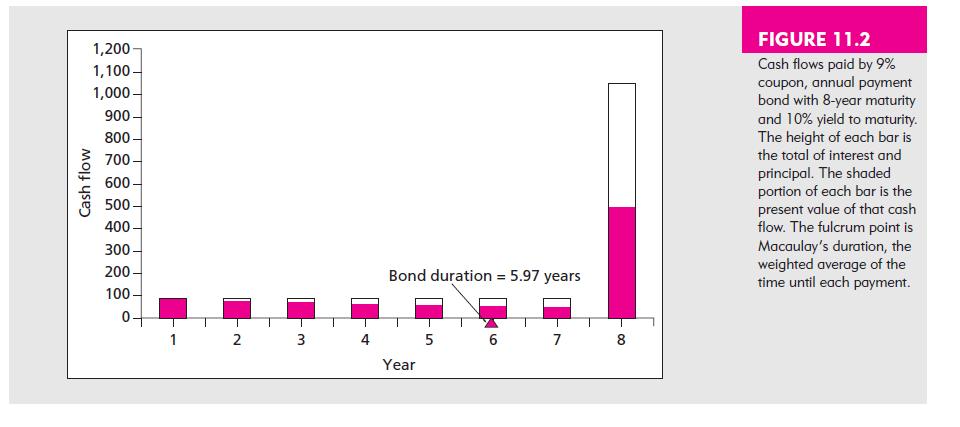

Figure 11.2 illustrates a 9% coupon, 8-year maturity bond with annual payments, selling at a yield to

Question:

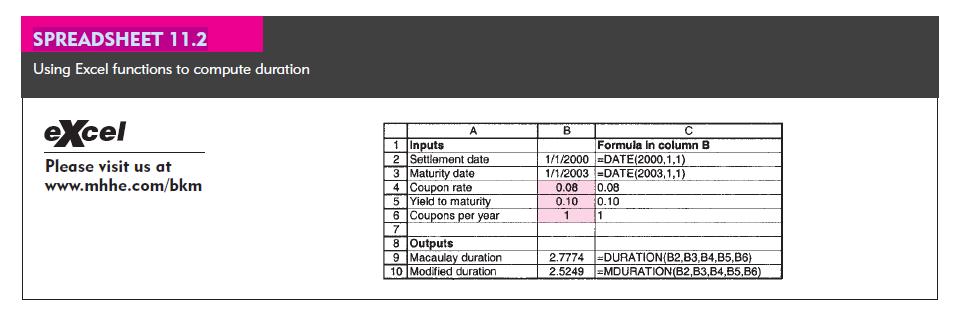

Figure 11.2 illustrates a 9% coupon, 8-year maturity bond with annual payments, selling at a yield to maturity of 10%. Confirm using Spreadsheet 11.2 that the bond’s duration is 5.97 years. What would its duration be if the bond paid its coupon semiannually? Why intuitively does duration fall?

Transcribed Image Text:

Cash flow 1,200- 1,100- 1,000- 900- 800- 700- 600- 500- 400- 300- 200- 100- 0 2 3 Bond duration = 5.97 years Year 5 6 7 8 FIGURE 11.2 Cash flows paid by 9% coupon, annual payment bond with 8-year maturity and 10% yield to maturity. The height of each bar is the total of interest and principal. The shaded portion of each bar is the present value of that cash flow. The fulcrum point is Macaulay's duration, the weighted average of the time until each payment.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

Use Excel to confirm that DURATIONDATE 200011 DATE 200811 09 10 1 597 years If you change the la...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Instructions: Enter all answers directly in this worksheet. When finished select Save As, and save this document using your last name and student ID as the file name. Upload the data sheet to...

-

On January 2, $217981 in 10-year, 5% bonds with a market interest rate of 9%, and interest payable semiannually, were issued for $185895. On June 30, bond interest was paid. On December 31, the...

-

What potential sources of error might be associated with the following situations? a. In a survey of frequent fliers age 50 and older, researchers concluded that price does not play a significant...

-

The alpha fetal protein test is meant to detect spina bifida in unborn babies, a condition that affects 1 out of 1,000 children who are born. The literature on the test indicates that 5% of the time...

-

The Tomlin Company's principal activity is buying milk from dairy farmers, processing the milk and delivering the milk to retail customers. You are engaged in auditing the sales transactions of the...

-

Vernon Corporation builds sailboats. On January 1, 2015, the company had the following account balances: $40,000 for both cash and common stock. Boat 25 was started on February 10 and finished on May...

-

1. How does the Bail system affect Minority? 2. How does the Bail System violate our constitutional rights? 3. How does the Bail System violate our 8 th and 14 th Amendments? 4. How is the Bail...

-

Show that the duration of a perpetuity increases as the interest rate decreases, in accordance with Rule 4. Rule 4: With other factors held constant, the duration and interest rate sensitivity of a...

-

a. In Concept Check 11.1, you calculated the price and duration of a three-year maturity, 8% coupon bond for an interest rate of 9%. Now suppose the interest rate increases to 9.05%. What is the new...

-

The data in Table 10.5.4 represent the mean serum cholesterol levels (given in milligrams per deciliter) by race and age in the United States from 1978 to 1980 Table 10.5.4 (a) Test at the 0.01 level...

-

What is forecasting risk and why is it important to the analysis of capital expenditure projects? What methods. can be used to reduce this risk?

-

Describe a government service or product that either the government charges money for -- or could charge money for -- and then discuss briefly whether you think the government's fee promotes...

-

Why does the quantity of Norwegian krone increase when the demand increases? The Norwegian central bank does not intervene, So how is it possible?

-

Some critics of using economics in medical decision-making confuse resource allocation with resource rationing. What is the difference between the two concepts?

-

Define the unemployment problems in Cameroon Africa. What population is affected by the unemployment? Where are the affected individuals located within the country? What are the resulting...

-

For the probabilities of Exercise 8 and the decision tree of Exercise 4, using the expected values found in Exercise 8, compute the standard deviations of the values associated with each action and...

-

Find the intercepts and then graph the line. (a) 2x - 3y = 6 (b) 10 - 5x = 2y

-

You have placed a stop- loss order on Kinross at $ 38, and the current bid and asked prices are $ 37.85 and $ 38.12, respectively. What does your order instruct your broker to do? Given market...

-

Consider the following limit- order book of a market- maker. The last trade in the stock took place at a price of $ 50. a. If a market- buy order for 100 shares comes in, at what price will it be...

-

Consider these long-term investment data: i. The price of a 10-year $ 100 par-zero coupon inflation-indexed bonds is $ 84.49. ii. A real estate property is expected to yield 2 percent per quarter...

-

Write the net force on each object in the picture below. Net force on A is (1) N, on B is (2) N, on C is (3) N, and on D is (4) N. 5 N 10 N A 10 N C 10 N B 10 N 15 N 5 N 15 N D Blank # 1 Blank # 2...

-

(10%) Problem 10: Consider the point charges arranged at the corners and at the center of a square, as depicted in the figure. ab O O qa 090 Og Find the magnitude of the net Coulomb force, in...

-

Part One: Please summarize the five steps required for Metallic Cartridge Reloading. Part Two: What safety precautions are needed as part of the process? Part Three: Finally, describe the best...

Study smarter with the SolutionInn App