Im concerned about the speed and scope top management pushes in our digital transformation, said Nikita Jones

Question:

“I’m concerned about the speed and scope top management pushes in our digital transformation,” said Nikita Jones to Antony Lee, her deputy head of customer service.

She and Lee were having a follow-up discussion after a board meeting where the CEO had outlined the bank’s aggressive push toward rapid digitization of its retail banking division.

The board and top management expected significant cost savings, better service quality, higher compliance, and easy scalability of its operations. However, Jones worried how the bank’s customers, many of them being wealthy Baby Boomers and Gen-Xers, would respond. After the meeting, the CEO had sent an email to share his vision; it clearly shows his enthusiasm for this accelerated push. It included the following:

Central for almost all businesses to survive is the digital and technological revolution we are all currently living through. I am convinced that the service sector is at an inflection point with regard to productivity gains and service industrialization, similar to the industrial revolution in manufacturing that started in the 18th century. Virtually all service sectors will be transformed by rapidly developing technologies that become better, smarter, smaller, and cheaper. This applies especially to technologies that are relevant in retail banking, such as AI, chatbots, analytics, machine learning, mobile technologies, apps, geo-tagging, biometrics, and text processing, speech processing, image processing, and so much more. 1 In combination, these technologies and service innovations have the potential to dramatically improve the customer experience and productivity all at the same time. Furthermore, many of these technologies have almost zero incremental cost. For example, AI and virtual service robots (e.g., voicebased chatbots) require significant investments for their development, but then can be scaled. Serving more customers has almost zero incremental costs.

Have a look at the case study of a leading bank that is already in the advanced stages of digitization and intelligent automation [see the section “Understanding the Power of IA through an Example” in this case]. This is where I envisage we will go, too. Thankfully, this bank is in a different geography and we are not competing with it!

By going faster than our local competitors, we may have the opportunity to gain significant market share! Let’s be proactive and make this our number one strategic direction. We want to become one of the world’s best digital banks taking full advantage of intelligent automation . . . but of course, with a personal touch, where needed and where it adds real value!

Jones shook her head and wondered, “How can we develop an implementation strategy that will be embraced by our customers? Do we need to structure our implementation by types of services, customers, profitability? What else do we need to worry about?” Then Jones recalled the customer survey a marketing agency had recently conducted. Jones and Lee looked through the findings of the focus groups and the representative quotes the research agency had pulled out that showed how customers might respond to chatbots and service robots:

For certain questions, it is completely sufficient to talk to a robot. And I like the fact that a chatbot is available around the clock and can help directly.

(Ava, age 36, nurse)

It’s very evident when it comes to finances, we’re talking about confidential, private, and sensitive information. I want to speak to my personal bank advisor, who has known me for years. (William, age 51, tax accountant)

It doesn’t matter whether I’m talking to a robot or an employee. What matters to me is that someone takes care of my request quickly. For me, the only thing that counts is whether I get the credit or not.

(Liam, age 30, entrepreneur)

As a loyal and good customer, I naturally expect a bit more service, starting with accessibility and that my requests are treated with priority. I don’t want to have to talk to a robot every time. (Toni, age 60, manager)

Especially for complex investment decisions, robots can retrieve and analyze all relevant data much faster and better, and humans make mistakes.

Therefore, I trust robots more than humans when things get complex. However, people can explain complicated financial products better and make me understand their relevance for my personal situation.

Is there a way to have both? (Sophia, age 43, doctor)

When it comes to analyzing the behavior of global stock markets, I believe that only AI can do that well. Ok, I have to trust an unknown system, but a human wouldn’t be able to do it better. We don’t have the capacity for that. (Thomas, age 48, IT specialist)

The diversity of opinions these quotes reflect left an impression on Jones. She planned to set up a meeting soon with her customer service team to discuss how they might approach intelligent automation, and importantly, mitigate potential negative customer responses.

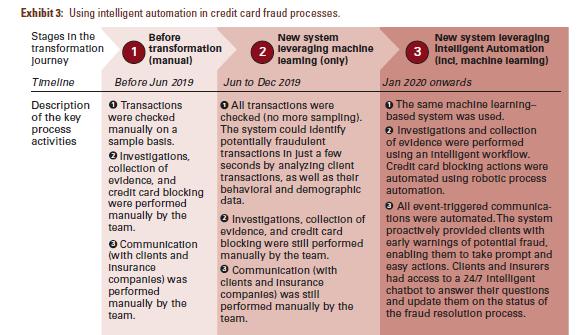

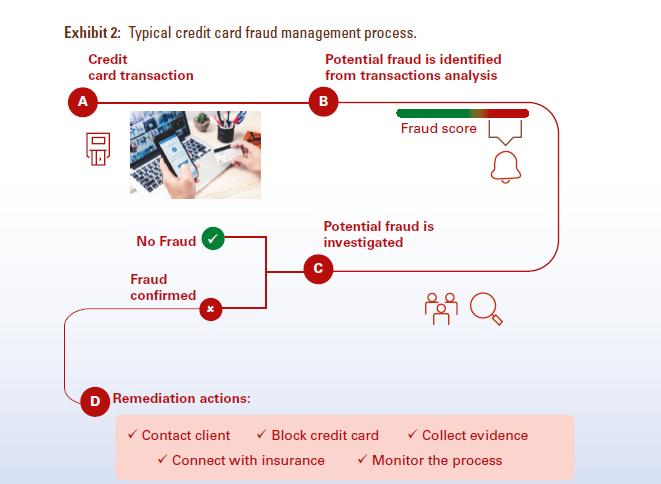

To improve customer experience and limit its losses due to card fraud, a leading bank decided to create a state-of theart machine learning–based program to identify fraudulent transactions automatically. This implementation increased the volume of fraud resolved by 30% in less than four months.

However, its employee and customer experience deteriorated (see Stage 2 in Exhibit 3).

To address this issue, the bank decided to take a more holistic approach. It requested support from a team in charge of IA at one of its subsidiaries. The first action from this team was to review and redesign not only the activity of fraud identification but also, more broadly, the end-to-end process with an emphasis on the customer and employee experience (see Stage 3 in Exhibit 3). While machine learning in Stage 2 automated only 20% of the process, the IA team succeeded in automating more than 80% in Stage 3.

STUDY QUESTIONS

1. For which types of service are AI-powered self-service technologies (SST) and service robots best suited and why?

2. Is there a difference between traditional SST, AI-powered SSTs, and service robots? Is there still a place for traditional SST?

3. How can customers be enticed to try and ultimately routinely use these new delivery channels? Does the bank need to segment customers based on their ability and willingness to adopt these smart delivery channels? Does the profitability of customers play a role?

4. What role does relationship management play in the implementation of AI-powered service delivery?

5. What are the strengths of human frontline personnel in comparison to AI-powered self-service technologies?

What type of services should be delivered by the bank’s employees? Does the profitability of these services play a role? What other considerations might be important?

Step by Step Answer: