Uber lost over $8 billion in 2019 and was expected to lose $6 billion by October 2020.

Question:

Uber lost over $8 billion in 2019 and was expected to lose $6 billion by October 2020. California Assembly Bill 5, a state statute, was expected to increase Uber’s operating cost dramatically. It would also be a major blow to Uber and other gig economy firms (e.g., Uber Eats, Grubhub, Deliveroo) if other states in the United States and other countries were to follow suit and propose labor laws similar to AB5. If so, Chief Executive Dara Khosrowshahi’s premonition back in 2019, when it filed for IPO, that Uber might never be profitable would indeed come true. 2 Was this law to become the beginning of the end for Uber?

THE BEGINNING

Uber was hailed as a disruptive force in transportation that could put taxi services out of business. Ever since Travis Kalanick and Garrett Camp founded Uber in 2009, this multinational ride-hailing company had expanded its services from ride-hailing (UberX, Uber Black, Uber Pool)

to food delivery (Uber Eats), to freight transportation (Uber Freight), to electric bikes and motorized scooter rental (through a partnership with Lime).

Uber’s smartphone app was well designed. By downloading the app and by linking it with a credit card, a customer, or rider, could immediately hail a ride by specifying the destination and pick-up location. The app provided the estimated price, and once the price was accepted, the app would match the rider with nearby drivers and then provide the name of their driver; their customer rating; the make, model, and license plate number of the car; the estimated time for the pickup;

as well as real-time tracking information about the location of the driver. At the end of the ride, the rider could leave a tip and rate the driver. This seamless service had been well received by riders.

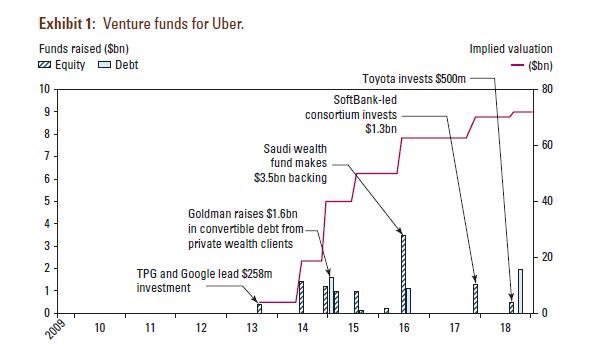

Uber operated in a two-sided market. Its success hinged upon massive rider and driver participation. To reduce waiting time for riders, Uber needed many drivers. At the same time, to reduce idle time and increase earnings for drivers, Uber needed many riders. To entice both riders and drivers to participate, Uber was able to use venture capital funds 3 to capture market share in many markets by heavily subsidizing drivers and riders, getting them to switch from taxis to Uber ( Exhibit 1 ). Investors gave Uber a valuation of over $70 billion even though it had lost billions of dollars every year except in 2018, the year before it filed for IPO.

The IPO

Uber celebrated its IPO in May 2019 with huge fanfare, but many investors were nervous about Uber’s profitability in the near future. To calm nervous investors, Khosrowshahi provided some assurance by emphasizing that (1) Uber was well positioned to penetrate a $12 trillion addressable market, (2) Uber’s platform was poised to become the “Amazon of transportation,” and (3) other companies like Amazon and Facebook also had rocky IPOs. Uber debuted on New York Stock Exchange at $42 per share, which was lower than its expected price at $45. After its IPO in 2019, the share price was hovering around $30 per share in 2020. Was this a reflection of investors’ doubts about Uber’s long-term success?

STUDY QUESTIONS

1. How could Uber retain its dominant position in the U.S. market? Are there are services or geographic nice markets where Uber should have accommodated Lyft?

2. How should Uber have competed with Lyft and other providers? Was the two-sided price competition (i.e., incentivizing drivers and riders alike to join and use its services) the right approach? How else could Uber have enhanced its competitive position?

3. Its customers and drivers were mulithoming (i.e., they signed up with its competitors). Should Uber have aimed at exclusivity (i.e., a 100% share-of-wallet), or was it more realistic to try to become the preferred provider with a high share-of-wallet?

Step by Step Answer: