Baker, a cash-basis, calendar-year taxpayer, is a partner in an accrual-basis partnership that reports its taxable income

Question:

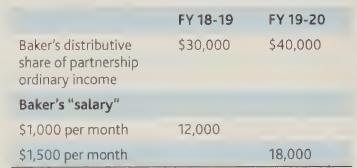

Baker, a cash-basis, calendar-year taxpayer, is a partner in an accrual-basis partnership that reports its taxable income on an October 31 fiscal year. Baker has been provided the following information:

The partnership was short of cash and paid none of the above to Baker until January 3, 2021. Compute Baker's income from the partnership for 2019.

Transcribed Image Text:

Baker's distributive share of partnership ordinary income Baker's "salary" $1,000 per month $1,500 per month FY 18-19 $30,000 12,000 FY 19-20 $40,000 18,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

To compute Bakers income from the partnership for 2019 we need to c...View the full answer

Answered By

Nicholas Maina

Throughout my tutoring journey, I've amassed a wealth of hands-on experience and honed a diverse set of skills that enable me to guide students towards mastering complex subjects. My proficiency as a tutor rests on several key pillars:

1. Subject Mastery:

With a comprehensive understanding of a wide range of subjects spanning mathematics, science, humanities, and more, I can adeptly explain intricate concepts and break them down into digestible chunks. My proficiency extends to offering real-world applications, ensuring students grasp the practical relevance of their studies.

2. Individualized Guidance:

Recognizing that every student learns differently, I tailor my approach to accommodate various learning styles and paces. Through personalized interactions, I identify a student's strengths and areas for improvement, allowing me to craft targeted lessons that foster a deeper understanding of the material.

3. Problem-Solving Facilitation:

I excel in guiding students through problem-solving processes and encouraging critical thinking and analytical skills. By walking learners through step-by-step solutions and addressing their questions in a coherent manner, I empower them to approach challenges with confidence.

4. Effective Communication:

My tutoring proficiency is founded on clear and concise communication. I have the ability to convey complex ideas in an accessible manner, fostering a strong student-tutor rapport that encourages open dialogue and fruitful discussions.

5. Adaptability and Patience:

Tutoring is a dynamic process, and I have cultivated adaptability and patience to cater to evolving learning needs. I remain patient through difficulties, adjusting my teaching methods as necessary to ensure that students overcome obstacles and achieve their goals.

6. Interactive Learning:

Interactive learning lies at the heart of my approach. By engaging students in discussions, brainstorming sessions, and interactive exercises, I foster a stimulating learning environment that encourages active participation and long-term retention.

7. Continuous Improvement:

My dedication to being an effective tutor is a journey of continuous improvement. I regularly seek feedback and stay updated on educational methodologies, integrating new insights to refine my tutoring techniques and provide an even more enriching learning experience.

In essence, my hands-on experience as a tutor equips me with the tools to facilitate comprehensive understanding, critical thinking, and academic success. I am committed to helping students realize their full potential and fostering a passion for lifelong learning.

4.90+

5+ Reviews

16+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Baker, a cash-basis, calendar-year taxpayer, is a partner in an accrual-basis partnership that reports its taxable income on an October 31 fiscal year. Baker has been provided the following...

-

Case Jeffrey Narley works for Layland & Co. (LNC), a Canadian Controlled Private Corporation (CCPC). Jeffrey, age 68, is married to Judy, who is 55. Jeffrey has a daughter from his first marriage,...

-

The following questions are adapted from a variety of sources including questions developed by the AICPA Board of Examiners and those used in the Kaplan CPA Review Course to study property, plant,...

-

Find f. f(x) = f'(x) = 12x + X x > 0, f(1) = -4

-

Two hundred kg/min of steam enters a steam turbine at 350C and 40 bar through a 7.5-cm diameter line and exits at 75C and 6.5 bar through a 5-cm line. The exiting stream may be vapor, liquid, or "wet...

-

Do you think the experiences of contingent workers and regular employees would have a better chance of being more similar to one another in a mechanistic or an organic organizational structure?...

-

What are the modifications necessary for using HRIS software applications that are designed for domestic companies in an MNE?

-

Consider Wal-Mart, a large retailer. Classify the following items as an Asset (A), a Liability (L), or Stockholders Equity (S) for Wal-Mart: a . _____ Accounts payable b. _____ Common stock c. _____...

-

Please create social messages for Twitter, Facebook, and Linkedln to promote the following article. Include attributions and hashtags specific to each platform. Make them fun so they stand out and...

-

Because it was anticipated that Bob Short would devote more time to the partnership than would his equal partner Jack Long, it was agreed that Bob would receive a "salary" of $12,000 per year. Bob...

-

Elaine is a 30% partner in the DEF Partnership. She sells some land to the partnership for $50,000, incurring a $30,000 loss on the sale. How much of the loss can she deduct? What happens if DEF...

-

If a 30 and b 15, then which of the following must also be true? a b 45 a b 15 a b 15 a + b 45 a + b 45

-

Define the following terms: run ticket settlement statement thief gauging strapping Henry Hub West Texas Intermediate North Sea Brent Blend Dubai crude

-

Any petroleum available for cost recovery in a particular year that is in excess of the amount necessary for cost recovery is referred to as _______________. a. Profit oil b. Cost recovery oil c....

-

Define the following terms: BS&W gravity tank battery LACT unit Mcf minimum royalty MMBtu

-

In addition to the PSC, what other type of contract might Alpha have in relation to Block 2? a. Lease agreement b. Risk-service contract c. Joint operating agreement d. Fixed margin agreement e....

-

Why is the temperature of oil or gas important when measuring the volume of oil or gas sold?

-

Blake Gillis, president of Wayside Enterprises, applied for a $175,000 loan from American National Bank. The bank requested financial statements from Wayside Enterprises as a basis for granting the...

-

General Electric Capital, a division of General Electric, uses long-term debt extensively. In a recent year, GE Capital issued $11 billion in long-term debt to investors, then within days filed legal...

-

Several years ago, Tampa Corporation acquired 100% of Union Corporation stock for $1,000,000. In the current year, Tampa liquidates Union and receives all of its assets and liabilities. Tampa...

-

Frank, Paul, and Sam are considering merging their respective unincorporated businesses into a new C corporation called FPS. Frank would transfer land and a building with a $50,000 adjusted basis and...

-

Beth, who is married, is the sole shareholder of Pet Store Inc., a C corporation. She also manages the store. She wishes to expand the business, but the corporation needs additional capital for her...

-

How do matrix organizational structures integrate cross-functional collaboration and manage the complexities inherent in dual reporting relationships ?

-

Design a service that takes in streams of messages from distributed sources and notifies its clients when certain specified patterns of messages occur. Discuss the design issues associated with...

-

How do mechanistic and organic organizational structures diverge in their fundamental principles, and what implications do these variances hold for adaptability and responsiveness to environmental...

Study smarter with the SolutionInn App