Bert and Barbara Longfelt support in nursing homes both Berts parents and Barbara's parents. Berts parents are

Question:

Bert and Barbara Longfelt support in nursing homes both Bert’s parents and Barbara's parents. Bert’s parents are 70 and 68 years of age respectively and have no income except for the $3,600 in Social Security they receive annually. Barbara’s parents, both 72 years of age, have the following sources of income:

Bert’s annual salary is $45,000 and his wife's annual salary is $55,000.

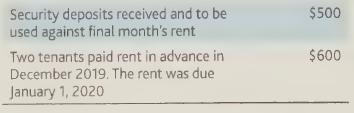

They have two small children who live at home. Also, they own an apartment house from which they derive $6,000 net rental income. Two items from their rental property confused them so they did not include them in their rental income:

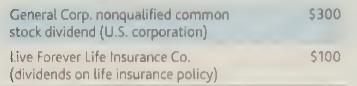

Barbara owned stock prior to her marriage to Bert and received the following cash dividends:

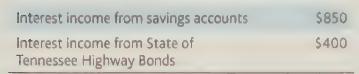

Bert and Barbara have several sources of interest income:

Barbara entered the local area bake-off, won first place for her cherry pie, and received a $1,000 cash prize.

Bert, who is an accountant, made an arrangement with Harold the dentist. Bert would do Harold’s tax work if Harold would take care of Bert and his family’s dental work. During the year, Bert estimated that the value of his services to Harold was $900 and that Harold gave Bert and his family $1,800 worth ofd ental services. In December, Bert did a consulting assignment on a weekend and received $700. No Social Security or taxes were withheld.

During the year, they had $15,000 withheld for federal taxes.

During 2019, Bert and Barbara have $26,000 ofi temized deductions. Compute Bert and Barbara's net tax due, including self-employment tax. Assume dividends are taxed at ordinary rates.

Step by Step Answer:

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback