Brad and Valerie decided to adopt a child and contacted an adoption agency in August 2017. After

Question:

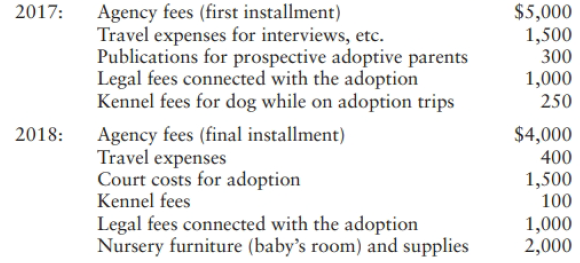

Brad and Valerie decided to adopt a child and contacted an adoption agency in August 2017. After extensive interviews and other requirements (such as financial status, etc.), Brad and Valerie were approved as eligible parents to adopt a child. The agency indicated that it might take up to two years to find a proper match. In March 2018, the adoption became final, and Brad and Valerie adopted an infant daughter (not a special needs child). Below is a list of expenses that they incurred:

Brad and Valerie's AGI in 2017 was $70,000, and in 2018 was $90,000.

a. Compute Brad and Valerie's qualified adoption expenses for each year.

b. Compute Brad and Valerie's adoption credit. In which year(s) may the credit be taken?

c. Would your answer to Part b change if the adopted child was a special needs child and if a grant covered all adoption cost except for legal fees?

Step by Step Answer:

Federal Taxation 2019 Individuals

ISBN: 9780134739670

32nd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson