Brent Fullback owned four passive activity interests in 2018: On March 2, 2018, Fullback sold his entire

Question:

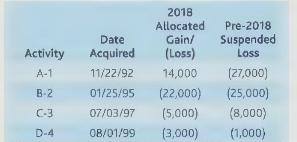

Brent Fullback owned four passive activity interests in 2018:

On March 2, 2018, Fullback sold his entire interest in A-1 for \(\$ 15,000\). His basis in the activity on January 1, 2018, was \(\$ 11,000\). Compute the following:

a. Gain or loss realized from the sale of A-1

b. Passive loss deduction (against nonpassive income) and type (i.e., ordinary income (loss) or capital income (loss))

c. Suspended losses and how they are allocated

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: