In 2017, Micah Johnson (SSN 000-22-1111) is employed as a manager and incurs the following unreimbursed employee

Question:

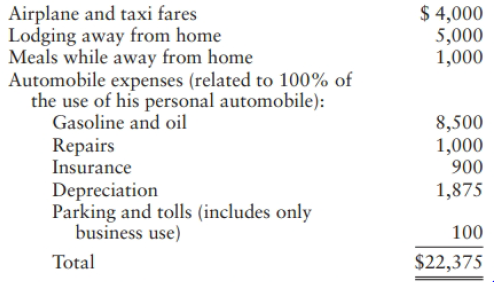

In 2017, Micah Johnson (SSN 000-22-1111) is employed as a manager and incurs the following unreimbursed employee business expenses:

Johnson receives a $7,800 reimbursement for the travel expenses. He did not receive any reimbursement for the auto expenses. He uses his personal automobile 80% for business use and placed his current automobile in service on October 1, 2013. Total business miles driven during the year amount to 26,400, his commuting miles in 2017 amount co 2,000 (average daily roundtrip of 7 miles), and other personal miles amount to 4,600 miles. Johnson's AGI is $60,000, and he has no other miscellaneous itemized deductions.

a. Calculate Johnson's expense deduction using the 2017 Form 2106 (Employee Business Expenses) based on actual automobile expenses and other employee business expenses.

b. Calculate Johnson's expense deduction for 2017 using the standard mileage rate method and other employee business expenses. (Assume that none of the restrictions on the use of the standard mileage rate method are applicable.)

Step by Step Answer:

Federal Taxation 2019 Individuals

ISBN: 9780134739670

32nd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson