In 2019, Joan Cannon incurred the following expenses relating to her vacation home: During 2019, Joan personally

Question:

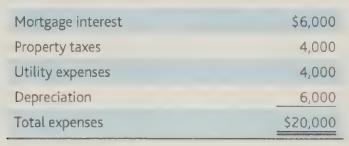

In 2019, Joan Cannon incurred the following expenses relating to her vacation home:

During 2019, Joan personally used the vacation home for 20 days. Determine the rental expense deduction that she is entitled to claim on her 2019 tax return in each of the following cases. Use the Tax Court method of allocating normal expenses allowable to all taxpayers.

a. Joan rents out the vacation home for 10 days during the year and receives $800 in rental income.

b. Joan rents out the vacation home for 30 days during the year and receives $1,500 in rental income.

c. Joan rents out the vacation home for 230 days during the year and receives $9,000 in rental income.

Step by Step Answer:

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback