In 2019 Tom and Shannon Shores, both age 40, filed a joint return and paid the following

Question:

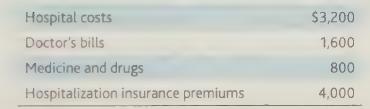

In 2019 Tom and Shannon Shores, both age 40, filed a joint return and paid the following medical expenses:

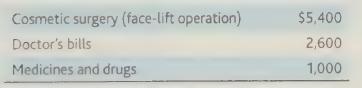

In addition, they incurred the following medical expenses for Tom’s mother who is totally dependent upon and lives with Tom and Shannon:

They live 10 miles from the medical center and made 20 trips there for doctor office visits and hospital stays this year. Tom and Shannon’s adjusted gross income is $85,000.

What is Tom and Shannon's medical expense deduction for this year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: