John and Ralph, two brothers who are over the age of 21, are beneficiaries of a trust

Question:

John and Ralph, two brothers who are over the age of 21, are beneficiaries of a trust created in 1983 by their father, Jim. At that time, Jim transferred securities and an apartment building to a corporate trustee.

All of the income is to be distributed annually to John and Ralph for 40 years.

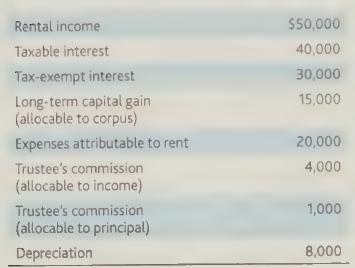

Depreciation follows income, and at the end of 40 years, the trust will terminate and the corpus will be distributed to John and Ralph. During 2019, the trust has the following items of income and expense.

Required:

a. Compute state law income.

b. Compute DNI as an income ceiling.

c. Compute DNI as a deduction ceiling.

d. Compute the trust's taxable income.

e. Compute DNI as a qualitative yardstick.

Step by Step Answer:

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback