Michael graduates from New York University and on February 1, 2017, accepts a position with a public

Question:

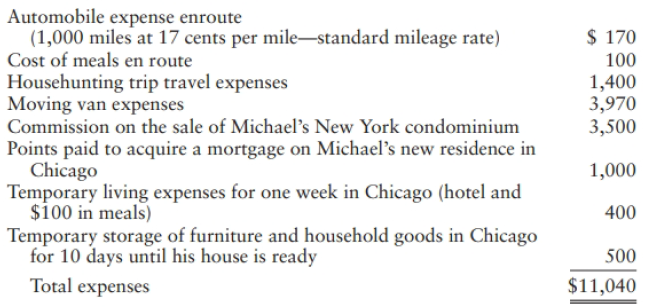

Michael graduates from New York University and on February 1, 2017, accepts a position with a public accounting firm in Chicago. Michael is a resident of New York. In March, Michael travels to Chicago to locate a house and starts to work in June. He incurs the following expenses, none of which are reimbursed by the public accounting firm:

a. What is Michael's moving expense deduction for 2017? How would your answers change if the tax year were 2018 rather than 2017?

b. Ho,v are the deductible expenses classified on Michael's tax return?

c. Ho,v would your answer co Part a change if all of Michael's expenses were reimbursed by his employer and he received a check for $11,040?

Step by Step Answer:

Federal Taxation 2019 Individuals

ISBN: 9780134739670

32nd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson