Refer to the facts in Problem 32. How much of the $10,000 income distribution will be taxable

Question:

Refer to the facts in Problem 32. How much of the $10,000 income distribution will be taxable to the beneficiary?

Problem 32

Refer to the facts in Problem 31. If a $10,000 distribution of income was made to a beneficiary during the 2019 tax year, what is the 2019 federal income tax liability of the estate? Assume that the decedent's will does not specify that the distribution is to be paid out of any specific type of income.

Problem 31

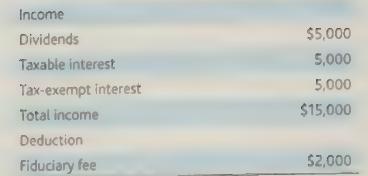

An estate receives the following items of income and has the following deductions during the tax year 2019:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: