To better understand the rules for offsetting capital losses and how to treat capital losses carried forward,

Question:

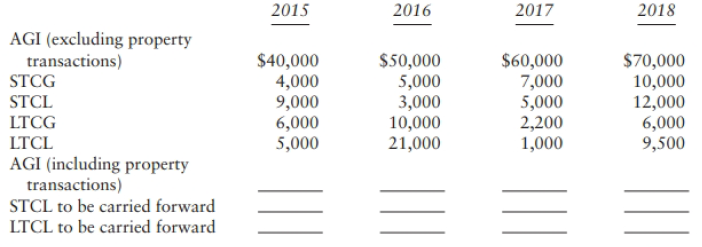

To better understand the rules for offsetting capital losses and how to treat capital losses carried forward, analyze the following data for an unmarried individual for the period 2015 through 2018. No capital loss carry forwards are included in the figures. For each year, determine AGI and the capital losses to be carried forward to a later tax year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2019 Individuals

ISBN: 9780134739670

32nd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson

Question Posted: