Permtemp Corporation (EIN: XX-1234567) formed in 2018 and, for that year, reported the following book income statement

Question:

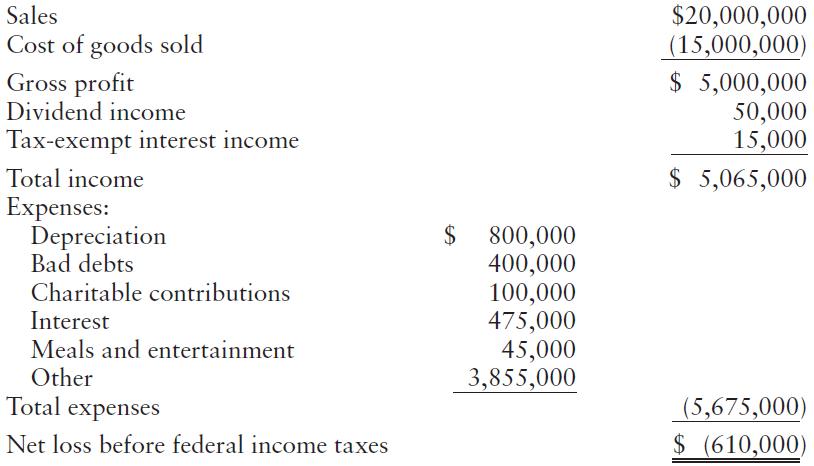

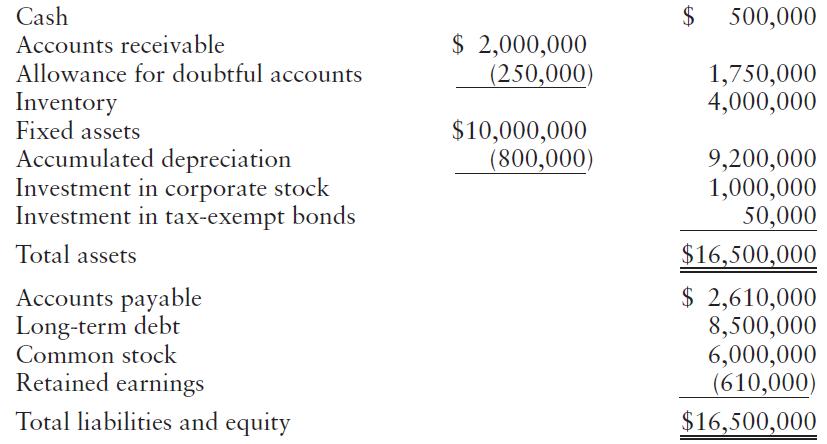

Permtemp Corporation (EIN: XX-1234567) formed in 2018 and, for that year, reported the following book income statement and balance sheet, excluding the federal income tax expense, deferred tax assets, and deferred tax liabilities:

Additional information for 2018:

• The investment in corporate stock is comprised of less-than-20% owned corporations.

• Depreciation for tax purposes is $1.4 million under MACRS.

• Bad debt expense for tax purposes is $150,000 under the direct writeoff method.

• Because of limitations, none of the charitable contributions will be deductible for tax purposes.

• Assume that $25,000 of the $45,000 meals and entertainment expenses pertained to entertainment and $20,000 pertained to business meals. Because of limitations effective in 2018, $35,000 of the meals and entertainment expenses will be disallowed for tax purposes.

• The corporate tax rate in 2018 was 21%. Required for 2018:

a. Prepare page 1 of the 2018 Form 1120, computing the corporation’s NOL.

b. Determine the corporation’s deferred tax asset and deferred tax liability situation, and then complete the income statement and balance sheet to reflect proper GAAP accounting under ASC 740. Use the balance sheet information to prepare Schedule L of the 2018 Form 1120.

c. Prepare the 2018 Schedule M-3 for Form 1120.

d. Prepare a schedule that reconciles the corporation’s effective tax rate to the statutory 21% tax rate.

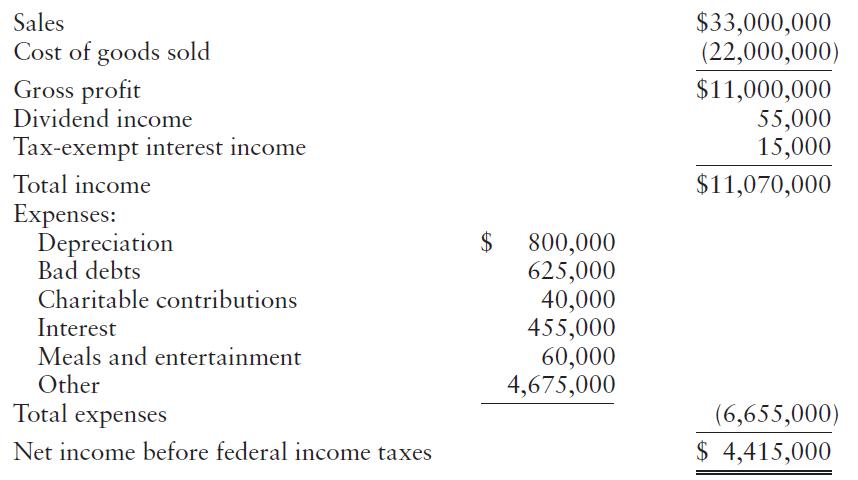

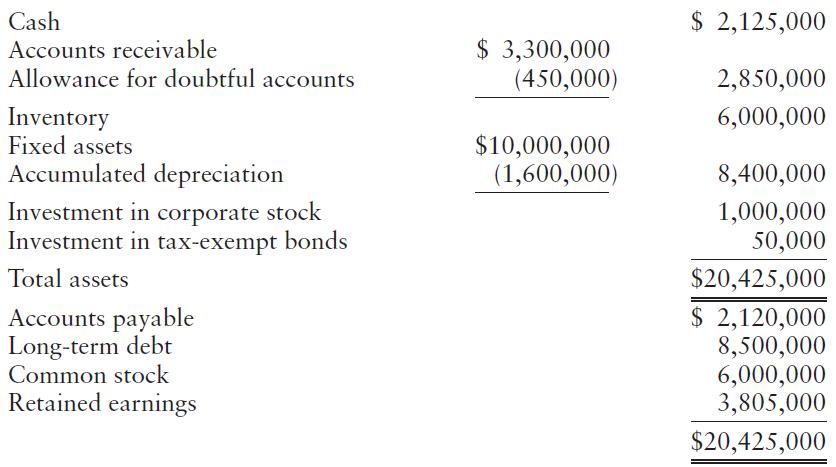

For 2019, Permtemp reported the following book income statement and balance sheet, excluding the federal income tax expense, deferred tax assets, and deferred tax liabilities:

Additional information for 2019:

• Assume that $40,000 of the $60,000 meals and entertainment expenses pertained to entertainment and $20,000 pertained to business meals. Because of limitations effective in 2019, $50,000 of the meals and entertainment expenses will be disallowed for tax purposes.

• Depreciation for tax purposes is $2.45 million under MACRS.

• Bad debt expense for tax purposes is $425,000 under the direct write off method.

• The corporate tax rate in 2019 is 21%.

Required for 2019:

a. Prepare page 1 of the 2019 Form 1120, computing the corporation’s taxable income and tax liability.

b. Determine the corporation’s deferred tax asset and deferred tax liability situation, and then complete the income statement and balance sheet to reflect proper GAAP accounting ASC 740. Use the balance sheet information to prepare Schedule L of the 2019 Form 1120.

c. Prepare the 2019 Schedule M-3 for Form 1120.

d. Prepare a schedule that reconciles the corporation’s effective tax rate to the statutory 21% tax rate.

Step by Step Answer:

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse