Sec. 338 Election. Gator Corporation is considering the acquisition of Bulldog Corporations stock in exchange for cash.

Question:

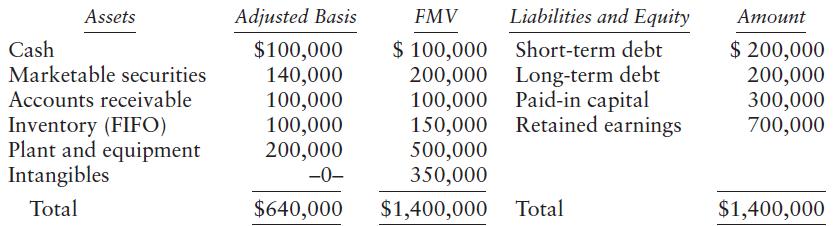

Sec. 338 Election. Gator Corporation is considering the acquisition of Bulldog Corporation’s stock in exchange for cash. It is reviewing two options: (1) Gator purchases the assets from Bulldog for $1.4 million or (2) Gator purchases the Bulldog stock for $1 million and makes a Sec. 338 election shortly after the stock purchase. Bulldog has no NOL or capital loss carryovers and has a 21% tax rate. Bulldog’s balance sheet is presented below.

a. What advantages would accrue to Gator if it purchases the assets directly? What disadvantages would accrue to Bulldog if it sells the assets and then liquidates?

b. What advantages would accrue to Gator if it purchases the Bulldog stock for cash and subsequently makes a Sec. 338 election? What advantages would accrue to Bulldog if its shareholders sell the Bulldog stock?

c. How would your answers change if Bulldog in the current year had incurred $250,000 of NOLs, which cannot be carried back?

Step by Step Answer:

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse