On December 20 of the current year, Winneld has decided to sell all of the stock that

Question:

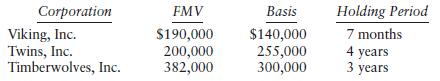

On December 20 of the current year, Winneld has decided to sell all of the stock that she owns and reinvest the proceeds in state of Minnesota bonds. Without considering the sales, her taxable income is expected to exceed $550,000 this year and in future years. Information about the stocks are provided below:

She is willing to sell some of the stock this year and the remaining stock next year if it is more advantageous to spread the sales over two years. Assume that the FMV of the stock will not change during the next 30 days, and ignore the effect of a sale on threshold amounts.

Determine the increase in her income tax for each of the following alternatives (a, b, & c) and advise Winneld, who is single.

a. Sell all stock this year.

b. Sell Twins and Timberwolves this year and Viking in March of next year.

c. Sell Viking and Twins this year and Timberwolves in March of next year.

d. Determine her Medicare tax on net investment income in Part a if she has no investment income before selling all the stock.

Step by Step Answer:

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse