The following items are relevant for the first income tax return for the Ken Kimble Estate. Mr.

Question:

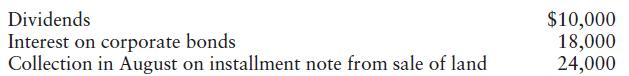

The following items are relevant for the first income tax return for the Ken Kimble Estate. Mr. Kimble, a cash method of accounting taxpayer, died on July 1, 2022.

The record dates were June 14 for $6,000 of the dividends and October 31 for the remaining $4,000 of dividends. The bond interest is payable annually on October 1. Mr.

Kimble’s basis in the investment land was $8,000. He sold it in May 2021 for a total sales and contract price of $48,000 and reported his gain under the installment method. Ignore interest on the installment note. What amount of IRD should the estate report on its first calendar year income tax return?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted: