Bobby's marginal tax rate has been low for several years because his sole proprietorship has had low

Question:

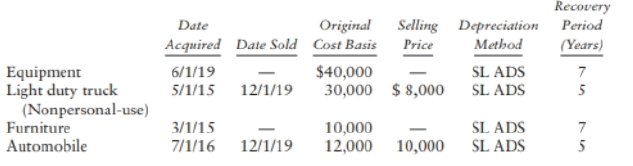

Bobby's marginal tax rate has been low for several years because his sole proprietorship has had low profits. Therefore, he has not elected Sec. 179 expensing, elected out of bonus depreciation, and elected to use the alternative depreciation system for property acquisitions. Bobby acquires, holds, or sells the following assets in 2019:

Assume the half-year convention applies for each year.

a. What is the depreciation deduction for each asset in 2019?

b. What amount of gain or loss does Bobby recognize on the properties sold in 2019?

Transcribed Image Text:

Equipment Light duty truck (Nonpersonal-use) Furniture Automobile Date Original Acquired Date Sold Cost Basis 6/1/19 5/1/15 12/1/19 3/1/15 7/1/16 12/1/19 Recovery Selling Depreciation Period Price Method (Years) $40,000 30,000 $8,000 10,000 12,000 10,000 SL ADS SL ADS SL ADS SL ADS 7 5 7 5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

a The depreciation deduction for each asset in 2019 2 34 of 1year st...View the full answer

Answered By

James Warinda

Hi! I’m James Otieno and I'm an experienced professional online tutor with countless hours of success in tutoring many subjects in different disciplines. Specifically, I have handled general management and general business as a tutor in Chegg, Help in Homework and Trans tutor accounts.

I believe that my experience has made me the perfect tutor for students of all ages, so I'm confident I can help you too with finding the solution to your problems. In addition, my approach is compatible with most educational methods and philosophies which means it will be easy for you to find a way in which we can work on things together. In addition, my long experience in the educational field has allowed me to develop a unique approach that is both productive and enjoyable.

I have tutored in course hero for quite some time and was among the top tutors awarded having high helpful rates and reviews. In addition, I have also been lucky enough to be nominated a finalist for the 2nd annual course hero award and the best tutor of the month in may 2022.

I will make sure that any student of yours will have an amazing time at learning with me, because I really care about helping people achieve their goals so if you don't have any worries or concerns whatsoever you should place your trust on me and let me help you get every single thing that you're looking for and more.

In my experience, I have observed that students tend to reach their potential in academics very easily when they are tutored by someone who is extremely dedicated to their academic career not just as a businessman but as a human being in general.

I have successfully tutored many students from different grades and from all sorts of backgrounds, so I'm confident I can help anyone find the solution to their problems and achieve

0.00

0 Reviews

10+ Question Solved

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

Bobbys marginal tax rate has been low for several years because his sole proprietorship has had low profits. Therefore, he has not elected Sec. 179 expensing, elected out of bonus depreciation, and...

-

Bobby's marginal tax rate has been low for several years because his sole proprietorship has had low profits. Therefore, he has not elected Sec. 179 expensing, elected out of bonus depreciation, and...

-

1. Betty contributed property with a $40,000 basis and fair market value of $85,000 to the Rust Partnership in exchange for a 50% interest in partnership capital and profits. During the first year of...

-

Peete's Coffee and Tea purchased equipment on March 1, 2022 for $17,400. It is estimated that the equipment will have a $300 salvage value at the end of its 6 -year useful life. It is also estimated...

-

Distinguish the role of the client from the role of the lawyer.

-

On January 1, 2017, Jamil Incorporated redeemed bonds prior to their maturity date of January 1, 2018. The face value of the bonds was $800,000, and the redemption was performed at 97. As at the...

-

Climate Change In July 2015, a poll asked a random sample of 1,236 registered voters in Iowa whether they agree or disagree that the world needs to do more to combat climate change. The results show...

-

Jake and Paul run a paper company. Each week they need to produce 1,000 reams of paper to ship to their customers. The paper plant's long-run production function is Q = 4K0.75L0.25, where Q is the...

-

On March 1, ABC Holdings purchased land and three buildings for $1,200,000. The plan was to use "Building 1" as an office and to demolish "Building 2" and "Building 3" to make room for a parking lot....

-

Beverly Plastics produces a part used in precision machining. The part is produced in two departments: Mixing and Refining. The raw material is introduced into the process in the Mixing Department....

-

Dana manages real estate and is a cash method taxpayer. She changes to the accrual method in 2020. Dana's business income for 2020 is 530,000 computed on the accrual method. Her books show the...

-

Serena Calman has twin adult children who currently have considerable income but have not saved much for their retirement. She is considering funding a trust that will accumulate income until they...

-

Appleby Southern Inc. had an accounts payable balance of $5 million at the end of 2015, and that balance rose to $7 million in 2016. What is the cash flow consequence of this change in accounts...

-

Which is not aimed solely at the poor? a) food stamps b) public assistance c) Social Security d) Medicaid

-

Rent is high because _____________________.

-

When the demand for a plot of land rises, ________. a) its supply will fall b) its supply will rise c) its price will fall d) its price will rise

-

The DarityMyers thesis is an attempt to explain _______. a) black poverty b) the poverty of elderly persons c) worldwide poverty d) the permanent underclass.

-

Consider the adopted per-unit system for the transformers. Specify true or false for each of the following statements: (a) For the entire power system of concern, the value of \(S_{\text {base }}\)...

-

For the three-phase circuit in Fig. 12.59, find the average power absorbed by the delta-connected load with ZΠ= 21 + j24Ω. ZA 100-1200 V rms 1.0 j0.5 100/120Vrms j0.5 1.0

-

A red card is illuminated by red light. What color will the card appear? What if its illuminated by blue light?

-

An exempt municipal hospital operates a pharmacy that is staffed by a pharmacist 24 hours per day. The pharmacy serves only hospital patients. Is the pharmacy likely an unrelated trade or business?...

-

Felipe will incur a $1 million Federal transfer tax when he passes a plot of land to Barbara, an unrelated friend. Felipe's after-tax rate of return on his real estate investments is 3%. Compute the...

-

With $5 million, Paul's will creates a trust with the following provisions: life estate to Jacob (Paul's son) and remainder to Anastasia (Paul's granddaughter and Jacob's daughter). Jacob dies when...

-

Write a method that computes the average of the values in an array of doubles. Write a complete Java class that will create a 2D array of randomly generatedintswith dimensions of 5 rows and 10...

-

What is the annual dividend on TXS preferred stock? If investors require a return of 8% on this Bock and the d dividend is payable 1 year from now, what is the price of TXS preferred stock? Suppose...

-

14) A managerial accountant should NOT disclose confidential information to an outside party (such as a newspaper) unless legally obligated to do so. 15) If a managerial accountant were NOT keeping...

Study smarter with the SolutionInn App