Cavan Company prepared the following reconciliation between book income and taxable income for the current year ended

Question:

Cavan Company prepared the following reconciliation between book income and taxable income for the current year ended December 31, year 1.

Pretax accounting income ...............................$1,000,000

Taxable income ...................................................(600,000)

Difference $ 400,000 Book-tax differences:

Interest on municipal income ...........................$ 100,000

Lower financial depreciation................................300,000

Total......................................................................$ 400,000

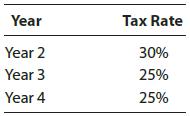

Cavan’s effective Federal and state income tax rate for year 1 is 30%. The depreciation difference will reverse equally over the next three years at enacted tax rates as follows.

In Cavan’s year 1 income statement, the deferred portion of its provision for income taxes should be:

a. $120,000

b. $80,000

c. $100,000

d. $90,000

Step by Step Answer:

South-Western Federal Taxation 2020 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357109175

23rd Edition

Authors: Annette Nellen, James C. Young, William A. Raabe, David M. Maloney