Cynthia, a sole proprietor, was engaged in a service business and reported her income on the cash

Question:

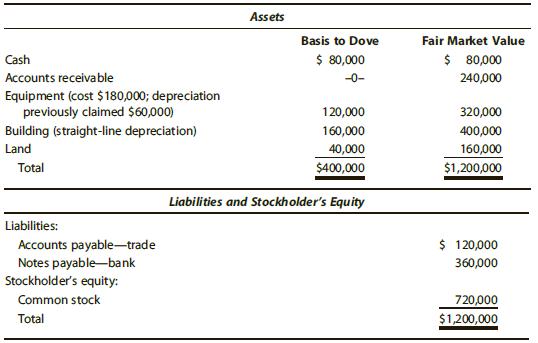

Cynthia, a sole proprietor, was engaged in a service business and reported her income on the cash basis. In February of the current year, she incorporates her business as Dove Corporation and transfers the assets of the business to the corporation in return for all of the stock in addition to the corporation’s assumption of her proprietorship’s liabilities. All of the receivables and the unpaid trade payables are transferred to the newly formed corporation. The balance sheet of the corporation immediately after its formation is as follows:

Discuss the tax consequences of the incorporation of the business to Cynthia and to Dove Corporation.

Step by Step Answer:

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young