Dana manages real estate and is a cash method taxpayer. She changes to the accrual method in

Question:

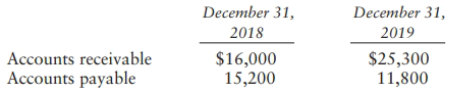

Dana manages real estate and is a cash method taxpayer. She changes to the accrual method in 2019. Dana's business income for 2019 is $30,000 computed on the accrual method. Her books show the following:

a. What adjustment is necessary to Dana's income?

b. How should Dana report the adjustment?

Transcribed Image Text:

December 31, 2018 December 31, 2019 Accounts receivable Accounts payable $16,000 15,200 $25,300 11,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

a The amount of the adjustment is 800 16000 15200 The receivables have not ...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2019 Comprehensive

ISBN: 9780134833194

32nd Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

What advantages does a cash method taxpayer gain by electing to accrue foreign taxes for foreign tax credit purposes?

-

When is a cash method taxpayer allowed to deduct deposits?

-

When is a cash method taxpayer allowed to deduct deposits? Discuss.

-

Hanley asks his assistant to collect details on those costs included in the $21,000 indirect-cost pool that can be traced to each individual job. After analysis, Wigan is able to reclassify $14,000...

-

Give production rules in Backus-Naur form for an identifier if it can consist of a) One or more lowercase letters. b) At least three but no more than six lowercase letters. c) one to six uppercase or...

-

1. Negative reinforcerdefine it. 2. Give an example of a. A negative reinforcer harmful to you b. A harmful stimulus that is not a negative reinforcer c. A negative reinforcer that is not harmful

-

After returning from a skiing vacation in Vermont, Leslie Adel came down with Legionnaires Disease. He claimed it was from the water drunk at the ski resort and provided by Greensprings of Vermont...

-

Using the net worth method, analyze the financial data at the bottom of this page for potential signs of fraud or embezzlement: 1. Do your results indicate that this person could be committing some...

-

Map this ER diagram to a Relational Model and normalize it if needed. employee EMP_ID INT EMP_Frame VARCHAR(40) EMP_Lname VARCHAR(40) EMP_Sex VARCHAR(1) EMP_Birthdate DATE EMP_Salary INT Indexes...

-

A company has four project investment alternatives. The required rate of return on projects is 20%, and inflation is projected to remain at 3% into the foreseeable future. The pertinent information...

-

Don owns equipment that he purchased several years ago for $400,000. Over the years he properly deducted $110,000 of depreciation. The depreciation will have to be recaptured as ordinary income on...

-

How much of the following expenses are currently deductible by a cash basis taxpayer? a. Medical prescriptions costing $20 paid by credit card (medical expenses already exceed the 7.5% of AGI floor)....

-

If Ronald selects the POS plan, what will his annual medical costs be? Ronald Roth started his new job as controller with Aerosystems today. Carole, the employee benefits clerk, gave Ronald a packet...

-

A bond has a face value of $10,000 and a conversion price of $46.04. The stock is currently trading at $35.02. What is the conversion ratio?

-

Draw the below array AFTER each of the following operations: (a) An array named FRUIT with initial item as Banana, Papaya, Pineapple and Watermelon. Max size for the array is 15. (b) Add item...

-

8. The XY Co. has sales of $198,000, net profit of $17,500, fixed assets of $125,400, current assets of $44,300. What is the total asset turnover rate?

-

A company received a government grant of 25% towards the purchase of the cost of a machine costing 120,000 during the year ended 31 March 2014. The plants residual value was 20,000 and has an...

-

A constant electric field accelerates a proton from rest through a distance of 1.70 m to a speed of 1.81 x 105 m/s. (The mass and charge of a proton are m = 1.67 x 10-27 kg and q = e = 1.60 x 10-19...

-

Hohenberger Farms purchased real estate for $1,280,000, which included $5,000 in legal fees. It paid $255,000 cash and incurred a mortgage payable for the balance. The real estate included land that...

-

Based on the scenario described below, generate all possible association rules with values for confidence, support (for dependent), and lift. Submit your solutions in a Word document (name it...

-

Amy has LTCGs that are taxed at different tax rates, 15%, 25% and 28%. She also has NSTCLs that amount to less than her NLTCG. The procedure for offsetting the NSTCL against the LTCGs is favorable to...

-

The effective tax rate on gain of $1 million resulting from the sale of qualified small business stock obtained in 2005 in an initial public offering and held more than five years is 14%. Do you...

-

Nancy and the Minor Corporation own bonds of the East Corporation. Minor Corporation owns 80% of the stock of East Corporation. East Corporation has declared bankruptcy this year, and bondholders...

-

A corporation reported cash or 1 5 , 3 0 0 and total assets of 1 8 0 , 0 0 0 on its balance sheet it's common size present for cash will be?

-

Morty Industries, which uses a process - costing system, adds material at the beginning of production and incurs conversion cost evenly throughout manufacturing. The following information was taken...

-

The following information has been extracted from the financial statements of a company. Net income in 2 0 1 6 = $ 3 , 0 0 0 Annual depreciation in 2 0 1 6 = $ 1 , 0 0 0 Net operating working...

Study smarter with the SolutionInn App