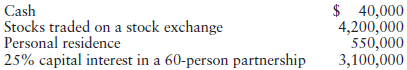

Elaine died on May 1, 2017. Her gross estate consisted of the following items: Elaines Sec. 2053

Question:

Elaine€™s Sec. 2053 deductions totaled $200,000. She had no other deductions.

a. What percentage of Elaine€™s federal estate taxes can be paid in installments under Sec. 6166? When is the first installment payment due?

b. Could Elaine€™s estate elect Sec. 6166 treatment if the stocks were valued at $6.2 million instead of $4.2 million?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: