Frank, Greta, and Helen each have a one-third interest in the FGH Partnership. On December 31, 2018,

Question:

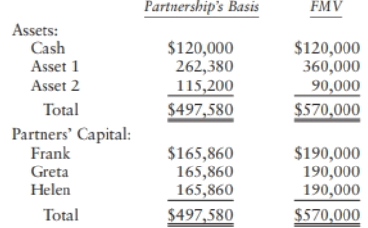

Frank, Greta, and Helen each have a one-third interest in the FGH Partnership. On December 31, 2018, the partnership reported the following balance sheet:

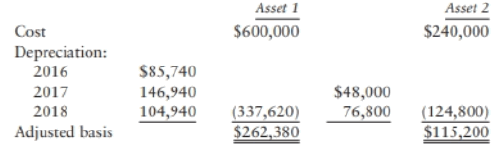

The partnership placed Asset 1 (seven-year property) in service in 2016 and Asset 2 (five-year property) in service in 2017. The partnership did not elect Sec. 179 expensing and elected out of bonus depreciation in both years. Accordingly, it computed the assets' adjusted bases at December 31, 2018 as follows:

At the end of business on December 31, 2018, Helen sold her partnership interest to Hank for $190,000. At the time of sale, the partnership had a Sec. 754 optional basis election in effect but has not elected to use the remedial method for allocating partnership items. Required: The partners have asked you to determine (1) the amount and character of Helen's gain or loss; (2) Hank's optional basis adjustment and its allocation to Asset 1 and Asset 2; and (3) the amount of depreciation allocated to Hank in 2019, including the ef-fects of the optional basis adjustment. At a minimum, you should consult the following resources:

? 1RC Secs. 743 and 751

? Reg. Sec. 1.743-1(j)

? Reg. Sec.1.755-1

Step by Step Answer:

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse