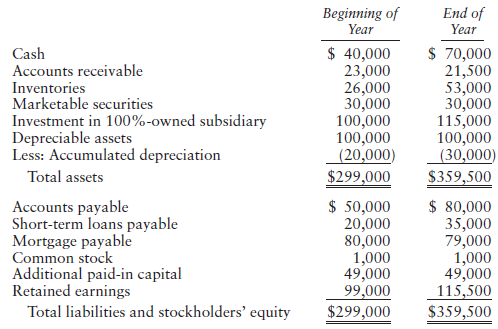

Huge Corporation reports the following balance sheet for the current year: Huge reports the following income and

Question:

Huge Corporation reports the following balance sheet for the current year:

Huge reports the following income and expenses for the year:Sales...................................................................................................$720,000Purchases............................................................................................570,000Dividend from 100%-owned subsidiary............................................30,000Dividend from less-than-20%-owned corporation..........................10,000Salaries (including officers? salaries of $30,000)...............................90,000Repairs...................................................................................................12,000Contributions........................................................................................60,000State and local taxes..............................................................................7,500Interest expense...................................................................................11,000Financial accounting depreciation......................................................10,000MACRS depreciation.............................................................................17,490Federal income tax expense per books.............................................10,000

In addition, Huge reported an NOL carryover of $12,000 from the preceding year and paid current year estimated taxes of $10,000.

Prepare a current year Form 1120 (U.S. Corporation Income Tax Return) for Huge. Leave spaces blank on Form 1120 for information not provided.

Step by Step Answer:

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson